Desire for Modern F&A Skills to Support Financial Close Transformation

Meet the Experts

Key Takeaways

⇨ The adoption of modern financial systems caused SAP users to want the ability to interpret and draw actionable insights from data, requiring many organizations to evaluate the need for financial close transformation.

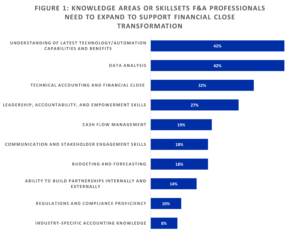

⇨ SAPinsiders said skillsets that include understanding technology and automation capabilities, technical accounting and financial close abilities, and data analysis are critical to support financial close transformation strategies.

⇨ To stay ahead of the curve in finance and accounting, professionals must continually develop their skillsets by staying up-to-date with the latest digital technologies and intelligent solutions.

As digital technologies continue to evolve, the transformation of the financial closing process represents a crucial priority for finance and accounting professionals and organizations. Automating routine closing cycle tasks can enable F&A teams to drive enhancements across the financial closing cycle. This is one of the key takeaways from the SAPinsider Financial Close Transformation benchmark report. Most survey respondents (85%) said automated and standardized closing processes were critical to financial close transformation strategies.

Financial close transformation strategies bring together digital technologies and highly-skilled financial and accounting professionals to work more efficiently with the latest tools. It is not about replacing finance and accounting professionals but harnessing the power of digital disruption. This allows them to do their jobs better by focusing on higher-value activities and providing enhanced insights that optimize business strategy. People remain at the heart of any successful organization and must upskill to support a culture of innovation. We will explore what drives the evolution of the finance skillsets for current and future finance and accounting professionals.

Latest Technologies Require Updated Skills

Traditional roles within finance departments will completely transform over the next few years as technological advances continue to shape the way we work. The role of chief financial officers (CFOs) and chief accounting officers (CAOs) are becoming increasingly strategic and focused on decisions that impact the entire organization rather than just the financial side. These changes will change the skillsets finance professionals need to remain relevant and competitive in their roles.

Explore related questions

One area where technology has a major impact is automation. Automation allows for more efficient data collection, which can generate insights that are key for understanding customer behavior, optimizing processes, making predictions about future trends, and more. It is becoming increasingly clear that organizations must broaden their finance and accounting knowledge to keep up with digital transformation. After all, the financial close processes of today are quite different from what they were in the past. It makes sense that respondent organizations said understanding the latest technology and automation capabilities and their benefits was the leading skillset needed to expand support of financial close transformation strategies (Figure 1). This allows for more efficient financial close processes and new opportunities for financial close transformation within organizations.

The adoption of modern financial systems, such as SAP S/4HANA, led to a shift away from focusing solely on collecting data towards being able to interpret and draw actionable insights from it. This requires both technical expertise and analytical thinking skills. That is why broadening skillsets, understanding the latest technology and automation capabilities and their benefits, , and knowledge of data analysis can enable finance and accounting professionals to derive meaningful insights from large-scale datasets to make smarter decisions.

Leveraging Updated Skills to Support Faster Close

Prioritizing data analytics can help uncover patterns in closing cycles across different periods. Combining technology and data analysis skills when working through the financial close process will be paramount in helping finance teams stay ahead of the competition. For many finance teams, leveraging automation solutions to enable a faster and more accurate close, such as those provided by BlackLine, helps organizations streamline their data to facilitate a move to a modern financial system.

Organizations must keep up with the financial trends of a changing business environment to stay competitive. Improving the financial close process is a way to maintain accuracy, compliance, and credibility. This includes expanding technical accounting and financial close knowledge areas. Having strong technical accounting and financial close abilities is critical to support an organization’s mission. It allows businesses to analyze data quickly to make crucial decisions in an ever-changing landscape. Leveraging this expertise enables organizations to understand how their finances contribute to overall business success and efficiently plan for future growth.

Supporting Financial Close Transformation Strategies

There is increased demand for finance and accounting professionals with technical knowledge and soft skills such as leadership, communication, and teamwork. Professionals that can bridge the gap between technical expertise and finance and accounting acumen will ensure the smooth adoption and implementation of modern financial closing technologies.

It is clear organizations will need a new breed of finance and accounting professionals who can not only handle traditional financial tasks but also understand how businesses can utilize emerging technologies to drive greater financial closing efficiency. To stay ahead of these changes, finance and accounting professionals must continually develop their skill sets by staying current with industry trends. Only then will finance and accounting professionals be well positioned to fully embrace digital transformation and fully support the financial close transformation strategies of SAPinsider organizations.

What Does This Mean for SAPinsiders?

- Expand your SAP skillset. With SAP Learning Hub, finance and accounting professionals can access resources to gain expertise in critical finance technologies like SAP S/4HANA and solution extensions from BlackLine. For even more support on your learning journey, take advantage of events and content offered by SAPinsider Finance Management.

- Embrace a culture of innovation at your organization. Organizations should strive for an open and enthusiastic culture of innovation to stay at the forefront of progress. Businesses can remain competitive in their industry by welcoming new technologies and exploring ways to refine existing processes.

- Establish a mindset of partnering with intelligent financial closing solutions. Embrace the potential of A.I. to revolutionize finance and accounting processes; don’t fall behind! Move forward with intelligent solutions that can increase your efficiency as a professional while streamlining financial closing cycles – making workflows more efficient.

Make sure to download and read our Financial Close Transformation Benchmark Report, available for all members of the SAPinsider Community.