SAP Central Finance

by Craig Spielman, Enterprise Architect, SAP North America Office of Innovation and Bob Jenkins, Business Architect, SAP North America Office of Innovation

By now, the possibilities to unlock competitive differentiation and business optimization with SAP S/4HANA, SAP’s next-generation enterprise management suite, are well-known. SAP HANA, the world’s most advanced data management and computing platform, is the technology foundation that enables S/4HANA to offer unparalleled process simplification and integration across a rich array of business capabilities and best practices. These have been refined through our decades-long deep relationships with tens of thousands of SAP customers across 26 industries.

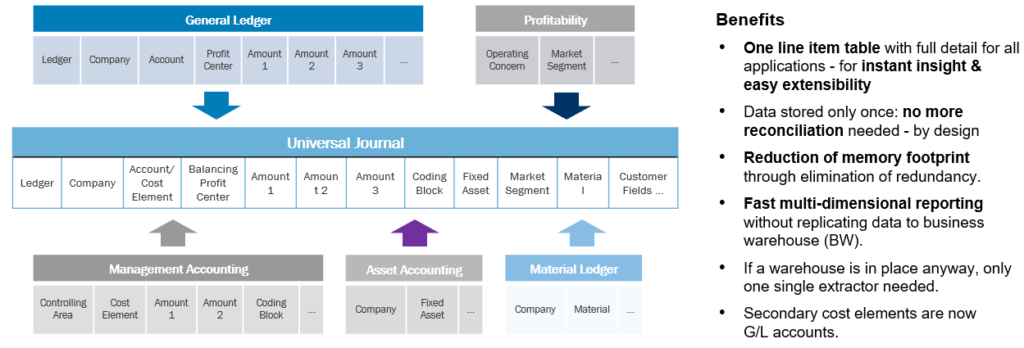

One of S/4HANA’s most important innovations has proven to be the Universal Journal. In basic terms, the Universal Journal contains all the company’s financially related transactions in a single table, instead of the myriad ledgers and supporting tables that were required in traditional ERP systems. As we’ll see shortly, this radically simplifies the world of finance and empowers a shift to real-time financial operations and reporting.

Moreover, for many companies the Universal Journal, deployed in concert with other SAP enabling technologies, opens another very compelling opportunity. Financial transactions from other SAP or non-SAP ERP systems can be replicated in near-real time to the Universal Journal in a single S/4HANA instance, allowing global data harmonization, visibility, and processing. This not only provides unprecedented enterprise-wide insight, control, and efficiencies, but also allows existing ERP landscapes to remain in place until they are ready to be incorporated into an S/4HANA transformation.

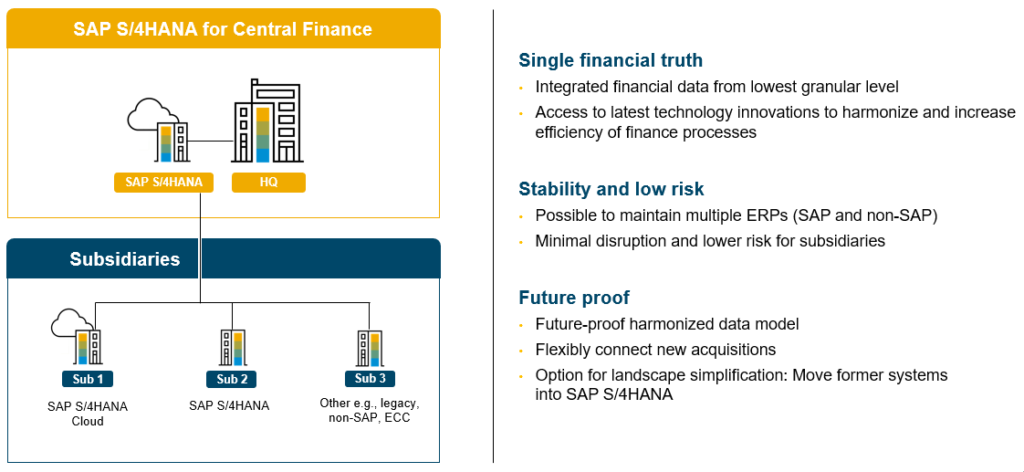

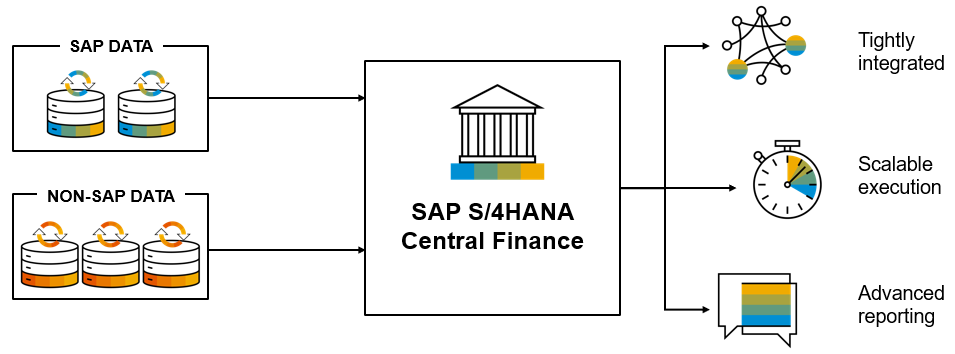

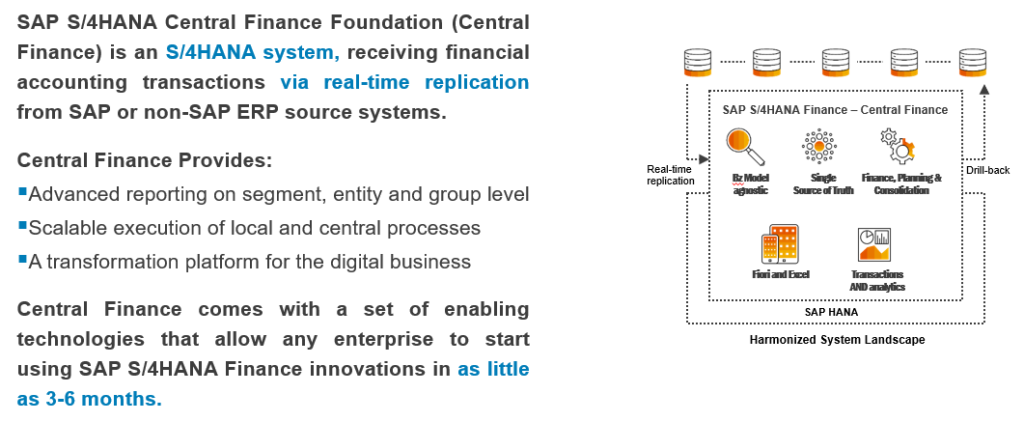

We call this innovation SAP Central Finance and Figure 1 shows these basic concepts. In the following discussion, we’ll explain why and how Central Finance powered by S/4HANA can be a game changer for companies looking to simplify their complex landscapes, get value earlier in large enterprise transformation programs, de-risk transitioning legacy systems to the target landscape, and/or accelerate the value of acquisitions.

Figure 1 – Holistic Financial View in a Multi-System Landscape with Central Finance

Why are SAP S/4HANA and Central Finance Important?

Before we explore the role of Central Finance in unifying the enterprise finance model, we need to understand the essential innovations in S/4HANA that make this possible. As we noted earlier, the Universal Journal within S/4HANA radically simplifies financial operations and reporting by flattening the data model. Figure 2 shows that, with SAP HANA as the data management foundation, we can store all financial information in one table at a transaction level. We no longer need separate sub-ledger tables, nor do we need to wait until period end and the reconciliation effort between them, just to be able to get a snapshot of the business. All the financial and management accounting information is inherently reconciled on an ongoing basis.

Figure 2 – The Universal Journal

Also, in contrast to traditional relational database systems, with SAP HANA there is no need to maintain indexes and aggregates for myriad tables. At the core of SAP HANA is a columnar, in-memory database that can combine transactional data into operational analytics on the fly in real time. S/4HANA comes with thousands of embedded analytical views – called Core Data Services (CDS), views – out of the box across all lines of business (LoBs). For finance teams, these views can be manipulated in a powerful, tightly integrated Excel front-end, as well as visualized in advanced dashboards using SAP Cloud Analytics (SAC). CDS views can also be extended, based on a customer’s needs, using ABAP development tools.

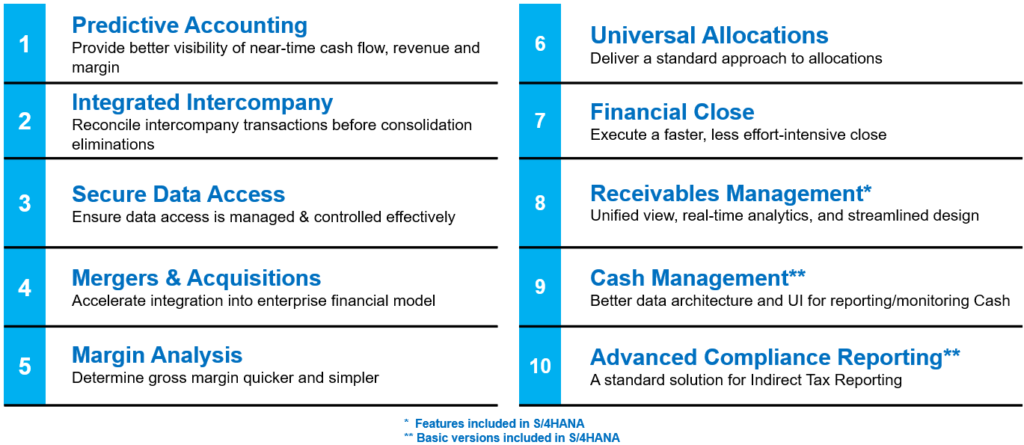

These innovations open the door for continuous financial operations, analysis, and reporting. Figure 3 demonstrates the top 10 improvements these innovations bring. The main areas of transformation include the following.

- Continuous Accounting … see the numbers as if you had closed the books at any time, distribute workloads across the accounting period and adopt a continuous improvement approach

- Continuous Intercompany Processing … eliminate manual processing with one version of truth and gain real-time access to intercompany information across the enterprise

- Continuous Intercompany Reconciliation … execute at any time in the period to avoid bottlenecks at period end, automatic matching on the fly

- Continuous Consolidation … automated intercompany eliminations, support financial and management reporting, single version of the truth for currency rates and transactions

- Real-time Business Unit Performance … analyze business KPIs based on detailed transactions and make more informed, timely decisions

- Real-time Customer and Product Profitability … at line item level over time, cost transparency, root cause analysis and traceback on single source of truth

- Real-time Receivables Management … automation of collection process, alignment with internal stakeholders to reduce DSO, optimized for global business services deployment

- Integrated Cash Management … consolidate all cash data into one single version of the truth, centrally manage global bank accounts, cash, payments, and liquidity

- Enterprise Planning and Analysis … integrated budgeting and forecasting, with SAP Analytics Cloud collaborative planning across finance and business units

Figure 3 – Top 10 Improvements for Finance Moving to SAP S/4HANA

One example of how many of these innovations can come together to transform finance into a real-time operation is depicted in Figure 4. The main advantages are clear: 1) executing accounting tasks continuously in the period instead of scrambling to do these at period end, 2) gaining valuable in-the-moment business insights that were only available as monthly snapshots, and 3) dramatically reducing the duration to produce the final period report.

Figure 4 – SAP S/4HANA Continuous Accounting and Group Reporting

Virtually all companies that deploy S/4HANA will rely on the Universal Journal and embedded analytics as core innovations at the heart of transforming financial operations and reporting. But what if a company with multiple, heterogeneous ERP systems could realize the power of Universal Journal and real time analytics in S/4HANA globally? What if this could be done while leaving the legacy ERPs in place until they are ready to be consolidated into the target-state S/4HANA landscape?

This is where the value of SAP Central Finance really shines. It allows companies to centralize and harmonize financial transactions from all their ERPs into an instance of S/4HANA, non-disruptively, in near-real time. Elevating the S/4HAHA innovations outlined above to a global level earlier in a landscape transformation can be a source of significant business value that supports the entire program, as well as finance. Later in this article we’ll see how SAP Central Finance architecture and technology enables these innovations but now we’ll continue to explore the areas of value Central Finance will drive.

What is the Value of SAP Central Finance?

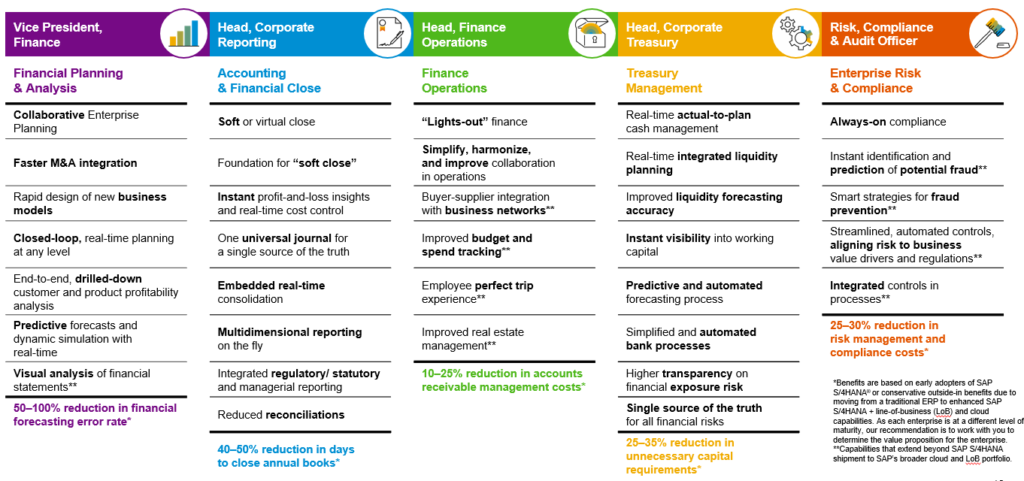

Generally, Central Finance allows companies to harness the power of S/4HANA innovations globally, particularly when they continue to wrestle with complex system landscapes. Figure 5 captures how all the points we have been making come together in Central Finance.

Figure 5 – SAP Central Finance: Real-time, Global Single Source of Truth

More specifically, S/4HANA and Central Finance innovations introduce the set of value pillars shown in Figure 6. These benefits present companies with opportunities to reimagine their business models for greater operating efficiency, better customer service, and improved financial performance as we’ll see momentarily. Underlying this promise is a harmonized finance model and set of financial processes at a global level. Companies that pursue Central Finance have the ability early in an enterprise transformation to design the target standards for charts of account, master data, policies, and organization, even before much of the total program has been executed. As we mentioned, many of the existing local systems can remain in place, but now everyone can clearly see the company’s direction and intent by virtue of the global finance operation having been established.

Figure 6 – Value Pillars of Central Finance

Further, these value pillars are realized by way of centralizing the S/4HANA financial processes we discussed above across the enterprise. Figure 7 introduces the concept of Central Finance establishing these advanced capabilities and innovations at a global level.

Figure 7 – Centralized Processes Enabling Continuous Accounting

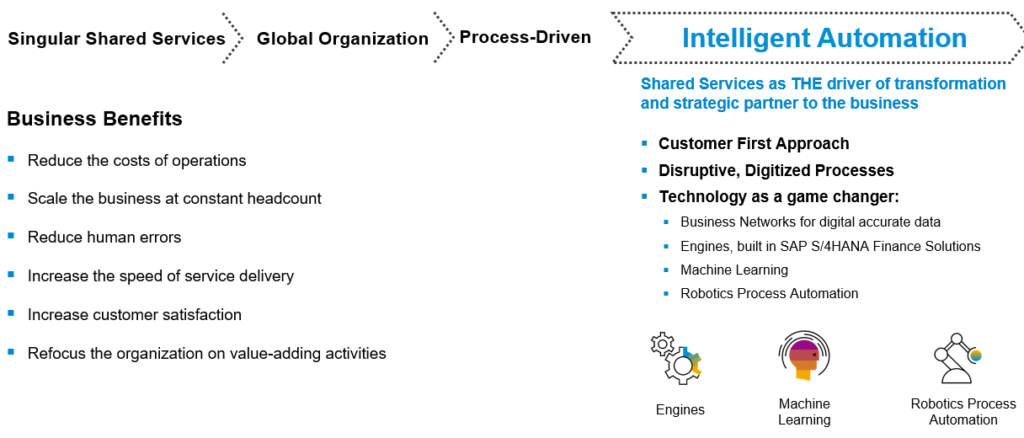

With Central Finance in place, streamlining the organization, increasing productivity, and scaling operations becomes feasible through global business or shared services models. Finance can also move from a traditional back office role to become a more strategic business partner by helping to increase profitability and contribute better informed insights into the decision-making process.

Figure 8 also adds to this the elements of intelligent automation, partner integration, and advanced data processing capabilities that are also built into S/4HANA. Utilizing machine learning algorithms and intelligent robotic processing capabilities within Central Finance dramatically increases efficiency and accuracy. Machine Learning identifies hidden patterns in knowledge-intensive processes and executes processing. Robotic process automation helps to run repetitive, rule-based, monotone tasks. Together, these allow businesses to focus their employees on more strategic, fulfilling, and higher value work.

Business networks that tightly integrate banks, suppliers, other external entities into the SAP landscape extend these benefits into the supply chain and help deepen the company’s business relationships. Finally, because Central Finance is deployed in an S/4HANA instance that runs on the SAP HANA data platform, there are a host of additional, advanced data processing and analytics capabilities that can introduce even more value. These include engines that analyze text and other non-structured data, as well as predictive analytics to help improve forecasting and modeling business scenarios.

Figure 8 – Automated Global Business Services

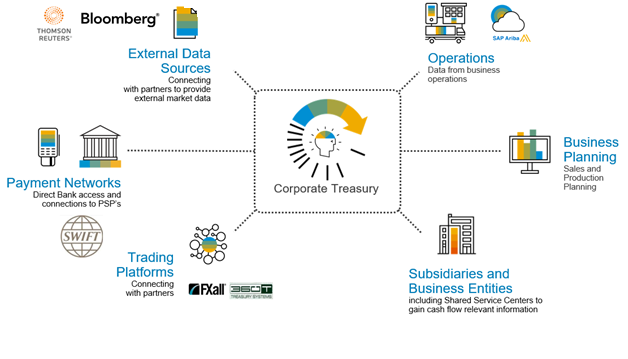

Treasury is a good example of the power of centralizing a key finance service on S/4HANA in a Central Finance deployment. As we can see in Figure 9, S/4HANA provides the advanced business capabilities, reporting, automation, and integration to external partners. Central Finance allows this to happen sooner, rather than having to wait for the company’s existing landscape complexity to be resolved. The financial data from subsidiaries and business entities are replicated in near-real time to S/4HANA in a harmonized financial model. We’ll learn more about how this occurs shortly.

Figure 9 – Corporate Treasury: Example of a Centralized a Key Function on S/4HANA Central Finance

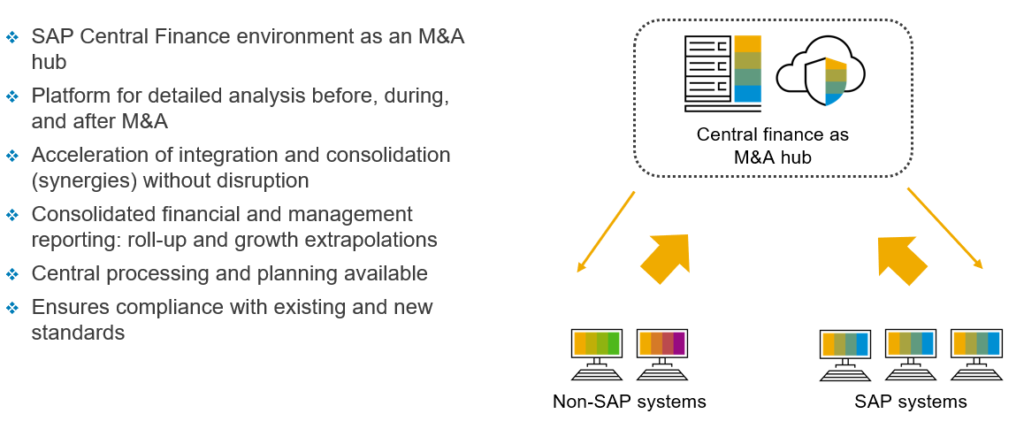

Another compelling area of value is in the realm of mergers and acquisitions (M&A). For companies that have a meaningful M&A strategy, the same S/4HANA innovations can be applied to new acquisitions in Central Finance deployment just as they can for existing business entities. In this scenario, Central Finance can deliver value that continues well beyond the completion of the transformation program. The main benefits of Central Finance for M&A are shown in Figure 10.

Figure 10 – Central Finance as the Hub for M&A

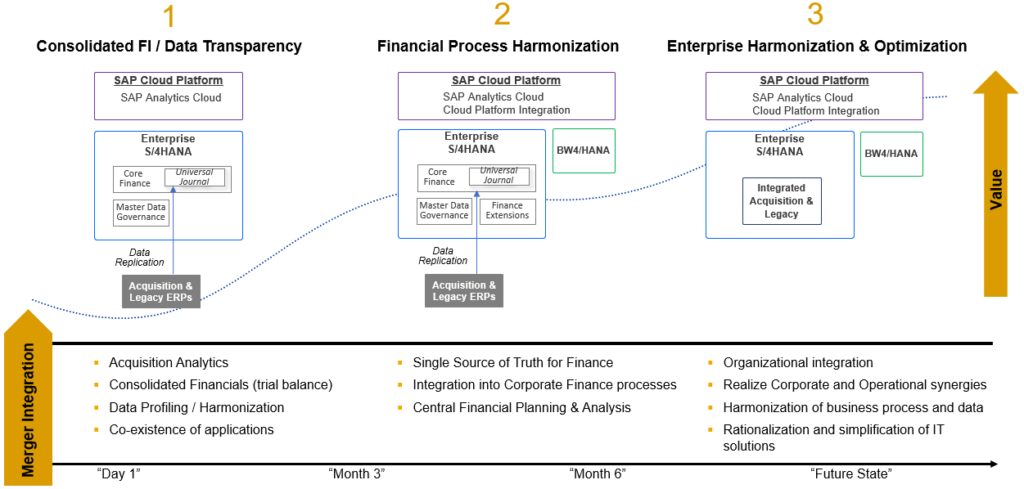

Figure 11 provides more information about the general phases of integration an acquisition could follow with a deployment of Central Finance on S/4HANA, significantly accelerating the time to value. In the traditional scenario, parent companies must contend with fragmented information and legacy processes until the new entity is fully transitioned in step 3, enterprise harmonization and optimization. In a Central Finance scenario, it’s now possible for the parent to integrate the acquisition into the enterprise reporting and process model much sooner, in step 1 (consolidated FI/data transparency) and step 2 (financial process harmonization), before the eventual full transition occurs. As Figure 11 also shows, there are additional SAP solutions that offer opportunities to extend S/4HANA’s ability to model and analyze data (BW/4HANA and SAP Analytics Cloud), and provide advanced development, integration, and technology services (SAP Cloud Platform).

Figure 11 – Central Finance for Faster M&A Time to Synergy

We began with the question “why are SAP S/4HANA and Central Finance important?” and explored their many compelling areas of value realization, risk mitigation, and business transformation. Let’s close this section with a holistic view of these advantages across the finance function. Figure 12 shows each pillar of enterprise finance and what specific benefits the leader of each function can expect to receive from S/4HANA and Central Finance.

Figure 12 – Tying it All Together: Enabling Tangible Results With S/4HANA and Central Finance

How Does Central Finance Work?

Now we’ll turn our attention to the specifics of how Central Finance provides value, starting at a conceptual level, moving through the main data management services it incorporates, and concluding with a view of the technical architecture. In Figure 13 we start with the basic notion of Central Finance: replicating data from existing SAP and/or non-SAP ERP systems to a harmonized state in the S/4HANA Universal Journal, and performing advanced financial processing, reporting, and analysis at an enterprise level. A key feature of this deployment model is that the existing ERPs continue running as before in each of their entities until they are ready to be transitioned to the target S/4HANA landscape.

Figure 13 – Central Finance Concept

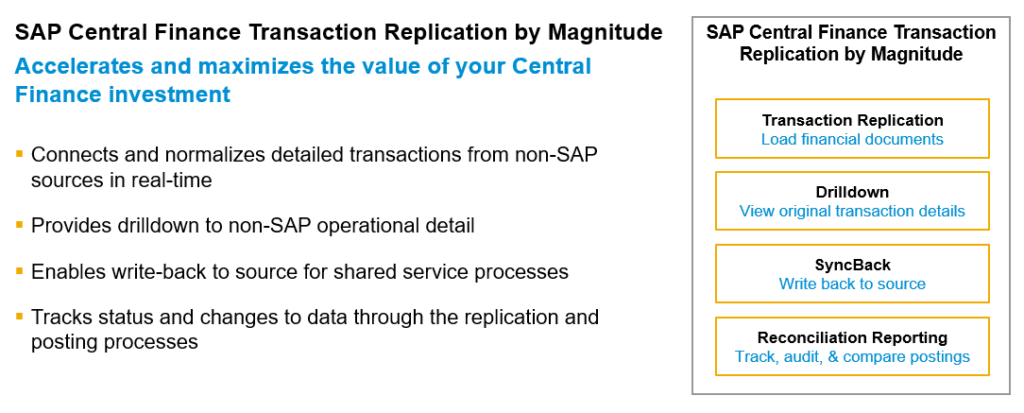

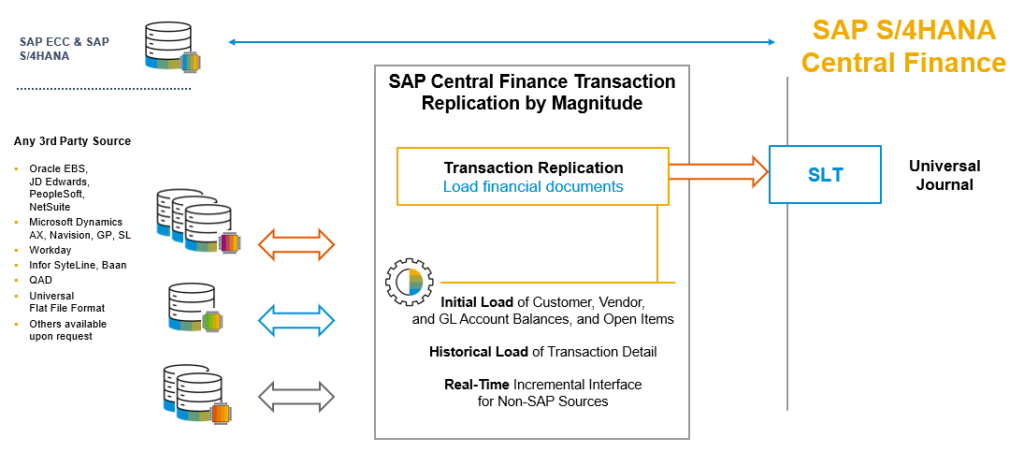

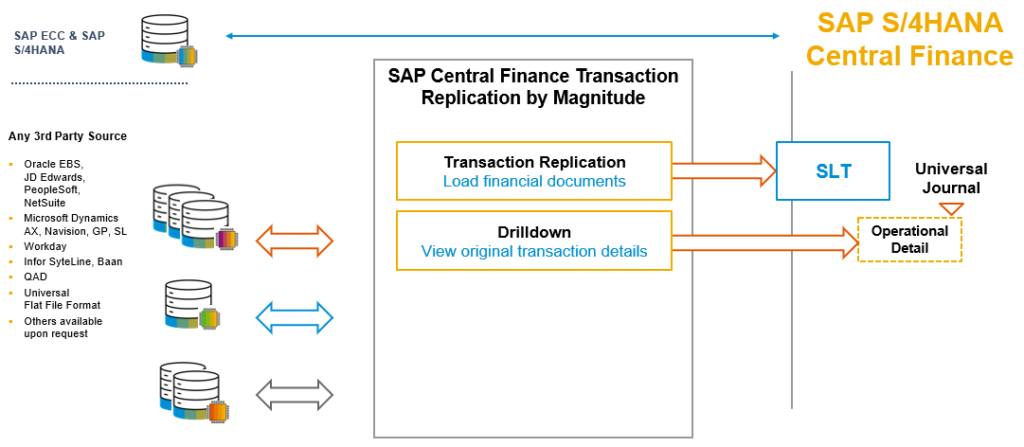

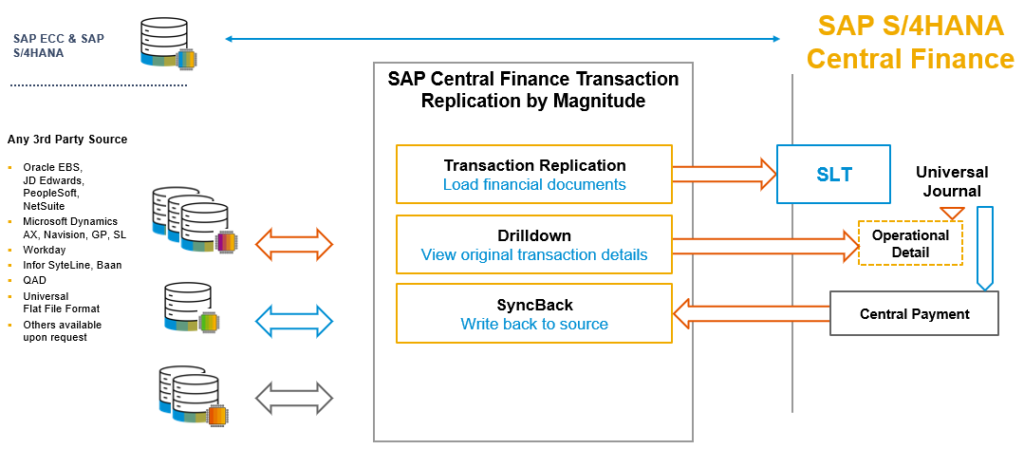

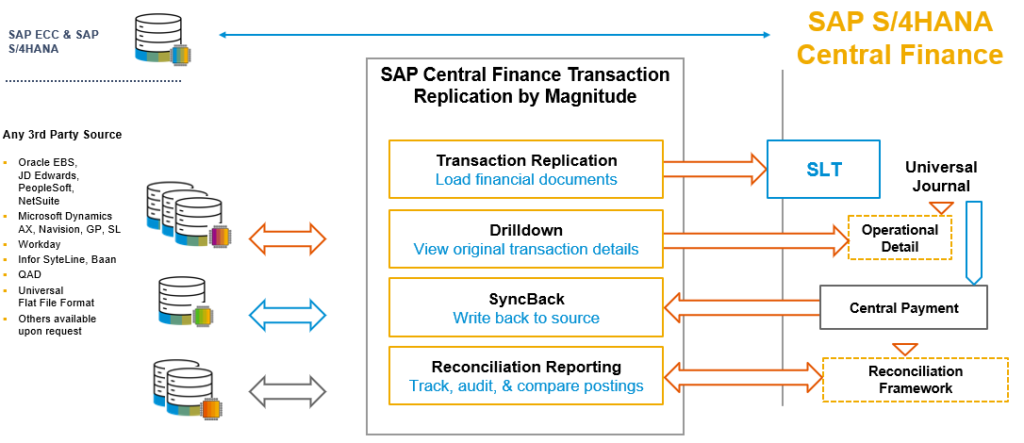

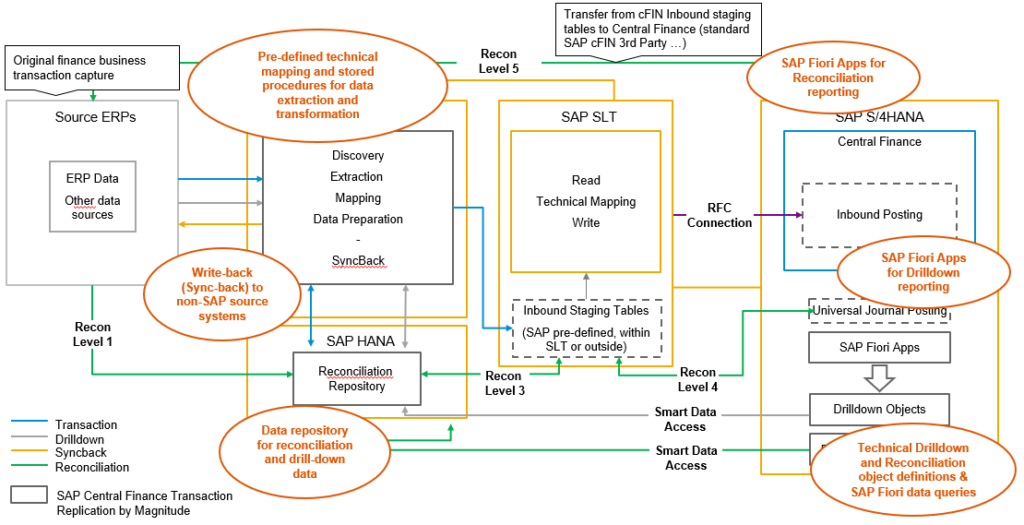

Expanding on this further, Central Finance incorporates four main data management services. Figure 14 shows a high-level view of these services, and the subsequent five illustrations (Figures 15 – 19) provide more detail about what each service does. Taken together, these services support a sequence of functional capabilities that connect legacy data to the harmonized model in the Universal Journal and then provide drilldown to the transaction details, allow writing back to the source system to clear AP and AR, and finally, deliver reporting for audit and reconciliation purposes. You will also notice that Magnitude Software is the primary SAP partner specializing in connecting non-SAP ERP systems to an SAP Central Finance system.

Figure 14 – Central Finance Transaction Integration by Magnitude

Figure 15 highlights the SAP Landscape Transformation (SLT) tool that replicates transactions from legacy systems to the Universal Journal in near-real time. In the legacy systems on the left, transaction replication is initiated (in non-SAP ERPs by way of database triggers or logging) to send to S/4HANA.

Figure 15 – Central Finance Transaction Replication

When a legacy transaction is replicated to S/4HANA, the data—including all its details—ends up in the Universal Journal. As we learned at the beginning, the power of the SAP HANA data platform allows transaction details to be used directly for real time operational reporting and analytics without the need to pre-aggregate the data or move it to another system, such as a data warehouse. But, as Figure 16 indicates, having the transaction details resident in SAP HANA also allows instantaneous drilldown as needed, avoiding the need to go back to the source system.

Figure 16 – Central Finance Drilldown

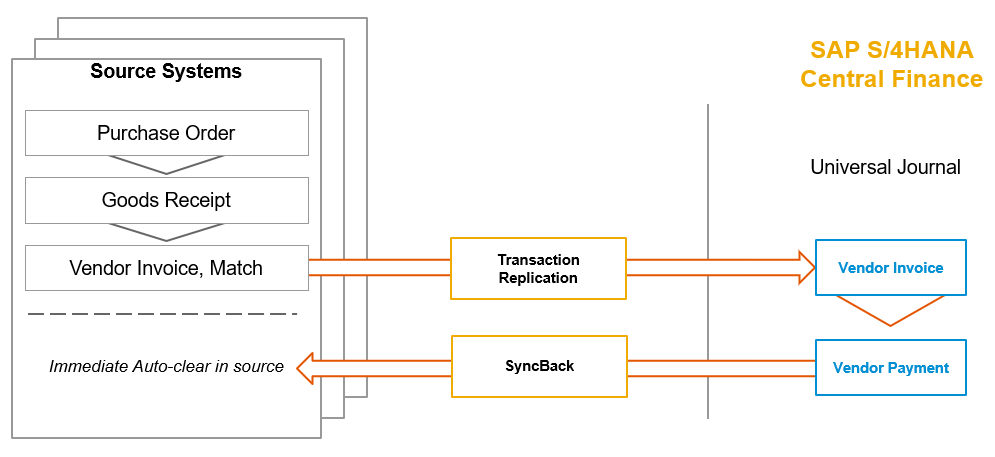

The next requirement is to be able to write back to the source system to clear transactions in AP and AR upon being processed in Central Finance. SAP does not recommend this for SAP source systems connected to Central Finance. For these SAP source systems, the best practice is to technically close postings in those systems at the time that they are replicated into Central Finance. Figure 17 shows this step while Figure 18 uses the example of AP clearing to illustrate the process more clearly.

Figure 17 – Central Finance SyncBack

Figure 18 – Example: AP Clearing in Source System

Figure 19 closes the loop on the process by providing monitoring capability to track, audit, and compare postings between the source and target systems.

Figure 19 – Central Finance Data Reconciliation Reporting

To restate, Central Finance is a deployment of S/4HANA that utilizes enabling technologies to integrate transactional data from legacy ERP systems. In addition to the data management services we reviewed above, a Central Finance implementation includes tools for mapping data between the source systems and the Universal Journal, preparing data and improving data quality, and establishing the checkpoints for data reconciliation through the process.

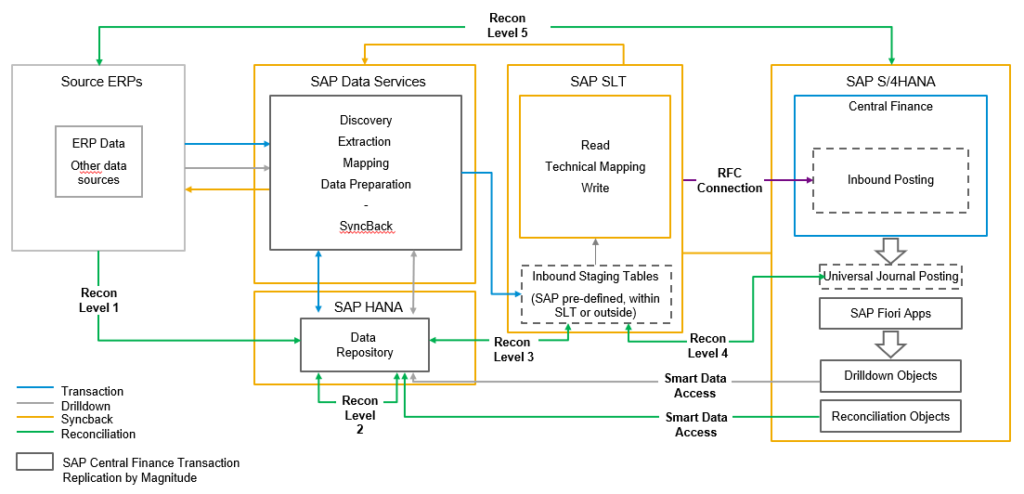

In Figure 20 we can see how the architectural components for Central Finance are structured. In addition to SLT, SAP Data Services plays an important role in connecting the source and target systems. While SLT is primarily the replication mechanism, Data Services is the mapping and preparation engine making sure that data is semantically correct between the systems.

Also, not shown in the architecture but worth pointing out, is Master Data Governance (MDG). Once data is mapped and prepared, MDG will keep the master data compliant with enterprise standards in the target landscape. MDG can be embedded within S/4HANA ERP or deployed as a standalone instance depending on the customer’s needs.

Figure 20 – Central Finance Technical Architecture

Figure 21 overlays information about more tools and services utilized in the architecture to show where and how they fit.

Figure 21 – Central Finance: How it Works

What are Central Finance Deployment Considerations?

Central Finance can add significant value in many enterprise deployment scenarios, but conversely, we need to be clear that it’s not advisable in every situation. By now we know that Central Finance is not simply a self-contained application package that is configured and implemented. There is indeed an application component, which is S/4HANA, but there are also other enabling data management and integration technologies that come into play, as well as mapping and other data preparation work that is part of the deployment.

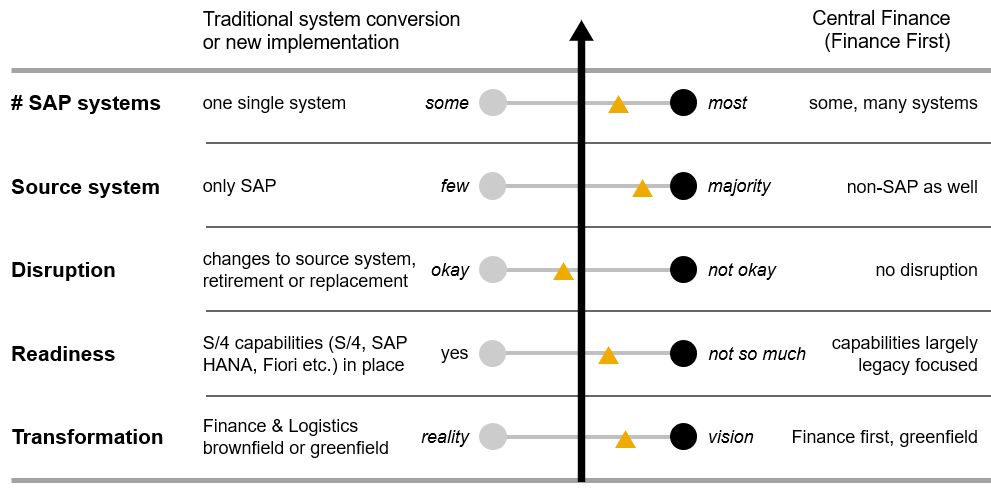

Figure 22 is a good starting point to gauge whether Central Finance deployment is appropriate in a given situation. There are five dimensions, each with a continuum and a yellow triangle that indicates the sweet spot for considering Central Finance. Generally, Central Finance is a good direction if an enterprise finance presence is needed early in the transformation of a complex landscape. This is also the case if business disruption is a critical consideration or if M&A is a key part of the company’s strategy.

Central Finance could also be warranted even if the existing landscape does not have multiple ERPs, but the company will transform business by business, or region by region, over an extended period. In this case, the legacy ERP will remain in the picture until all the entities are transitioned. A Central Finance deployment could provide the company with an opportunity to establish a centralized finance operation in the interim. The Central Finance S/4HANA instance can also become the target system containing all best practices and new enterprise configurations, into which all business entities would move over time.

Figure 22 – Scenarios for Moving to Central Finance

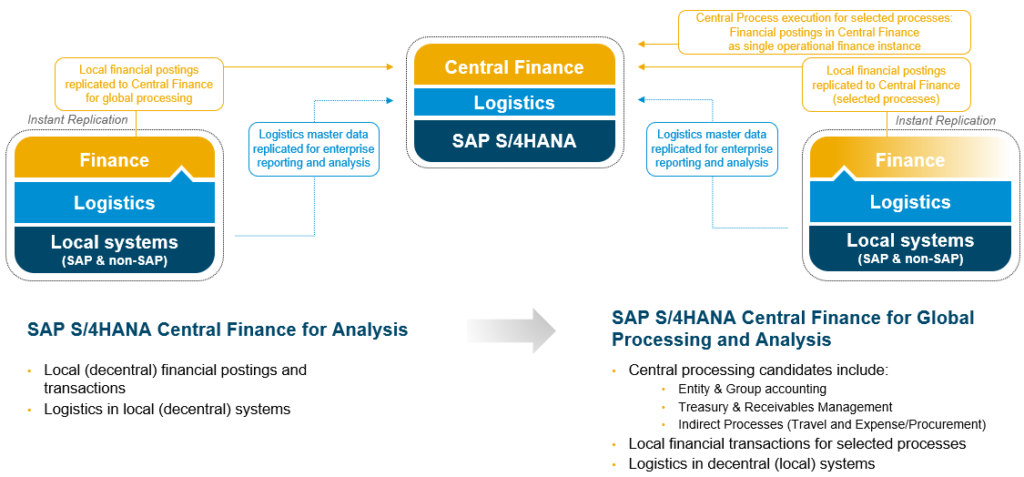

By using mature deployment practices, capable tools, and experienced SAP partners, implementations can be efficient and timely. It’s important to also note that Central Finance itself can be deployed in stages to further manage deployment scale and risk. A company may choose to start with a focus on internal analysis, for example. Then, external reporting and consolidation can be added with other global financial processes being addressed in future phases. Figures 23 and 24 illustrate these points.

Figure 23 – Central Finance as Decisional or Single Operational Instance

Figure 24 – Non-disruptive Step Towards Central Finance

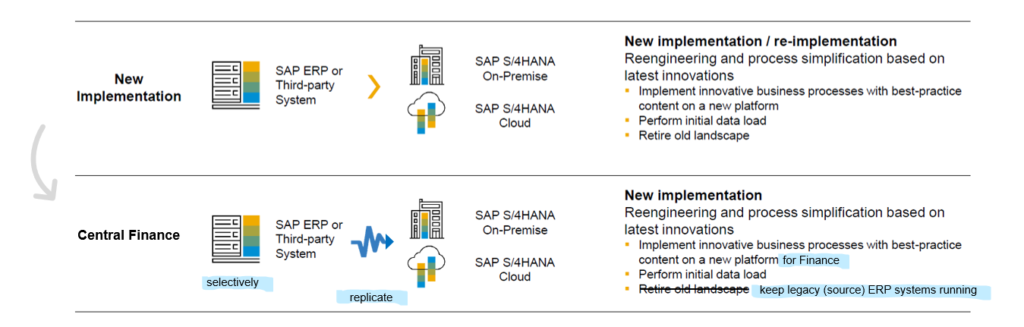

Let’s finish the deployment discussion by comparing a typical new S/4HANA implementation with a Central Finance strategy in Figure 25. As expected, in a new implementation the legacy ERP transitions to S/4HANA and is then retired. The logistics as well as finance processes are now running on S/4HANA. Central Finance, on the other hand, is running the finance at an enterprise level while the legacy ERP continues to operate locally.

However, it’s important to emphasize some of the nuances we considered earlier in the article. First, although Central Finance is most appropriate for a multiple ERP landscape (which can include non-SAP systems), using Central Finance in the case of a single legacy ERP can make sense. This is especially true if it will take several years to move subsidiaries, businesses, or regions to the new S/4HANA system. Here, a global finance layer can also add substantial value while the legacy ERP is still running the entities that have not yet transitioned. Second, a company with a heavier M&A strategy can benefit from a Central Finance deployment irrespective of either implementation scenario shown in Figure 25.

Figure 25 – Comparing a New S/4HANA Implementation to a Central Finance Deployment

Conclusion

In virtually any move to SAP S/4HANA and the Universal Journal; process integration, automation, and simplification; and advanced data management will enable finance teams to improve productivity and become a more strategic partner to the business. In many enterprise transformation and M&A scenarios, Central Finance will substantially accelerate the realization of this business value as well as provide a solid global foundation for finance operations to adopt going forward.

Central Finance is based on a mature architecture and proven deployment model. This provides the ability to seamlessly connect heterogeneous ERPs to S/4HANA and maintain transaction integrity between these systems. It allows real time, harmonized financial visibility, analysis, and detailed reporting at an enterprise level. The state of the business can be rapidly ascertained at any point in the period, instead of this only being possible at period end. The in-the-moment insights that are gained can drive timely, impactful decisions.

SAP customers have embraced Central Finance to realize the benefits we have discussed. As of April 2020, there are over 400 licensed customers for Central Finance, with more than 150 projects and 75 live implementations. Two examples highlight the many cases where Central Finance has been instrumental in the transformation journey. A global candy and snack company unified its financial processes and data across the enterprise, which simplified decision making, increased process transparency, and reduced financial closing cycles. An energy company doing business in 30 countries on 5 continents streamlined its finance operations and reporting model, allowing it to continue modernizing the enterprise and transforming how it serves customers.

To learn more about the value of SAP Central Finance and how SAP S/4HANA can enable competitive advantage for your company please contact your SAP Account Executive. Our SAP industry, line-of-business, product, and technology experts are ready to help you.

About the Authors

Craig Spielman has been an Enterprise Architect in the SAP North America Office of Innovation for four years. He has been advising SAP customers across many industries to establish their strategic transformation architecture and roadmap, helping them realize a compelling business case. Prior to SAP, Craig led global IT over several years for a leading aerospace metals innovator. He also had a diverse career at the world’s foremost manufacturer of semiconductor assembly equipment, first on the business side in product marketing and customer operations, and later in IT delivery and management.

Bob Jenkins has worked in a variety of roles in the SAP North America Office of Innovation for over 25 years. Currently, Bob is a Business Architect, guiding organizations that are focused on transforming and optimizing their financial processes. In the past four years he has become a Central Finance thought leader, having worked with many clients to determine if Central Finance is the right financial transformation approach for their business. Prior to SAP, Bob was a senior manager at multiple software services firms, delivering quality financial solutions to multiple global businesses.