Build an Integrated Financial Platform Strategy for SAP S/4HANA

Many companies are eager to move to SAP S/4HANA Finance to take advantage of the in-memory platform’s improved capabilities and real-time reporting. However, it is important to ensure your data and processes are ready to take full advantage of what SAP S/4HANA Finance has to offer.

Read the transcript of the discussion with Dolphin and SymQ experts to learn how the finance department can build a roadmap for an integrated financial platform. They shared tips and best practices for how you can reduce risk and improve your return on investment in SAP S/4HANA Finance, answering 30 reader questions, including:

- Is there a way we can start small and only use selected functionality in SAP S/4HANA Finance?

- What steps can companies take to prepare data in advance of a move to SAP S/4HANA?

- Hw challenging is consolidating multiple instances and different functionalities in different systems on to SAP S/4HANA?

- Can you share RPA and AI use cases where these technologies were used for significant benefits in financial processes?

- For SAP S/4HANA, what methods are companies using to train users on new functionality?

- Is a new general ledger (G/L) technical upgrade still required to migrate from ECC 6.0 to SAP S/4HANA?

Matthew Shea

Hello, and welcome to today’s Q&A. We will be discussing SAP S/4HANA Finance with Dolphin’s Chief Strategy Officer, Brian Shannon, and SymQ’s Managing Director, Jochen Stiebe.

Welcome, Brian and Jochen!

Brian Shannon: Thank you, Matthew.

Jochen Stiebe: Thank you, Matthew

Matthew Shea: What are some of the biggest challenges facing finance teams today as we prepare for the future with SAP S/4HANA?

Brian Shannon: Well, the rapid pace of change is definitely a challenge for many finance departments. New electronic audit reporting requirements such as Nota Fiscal and Standard Audit File for Tax (SAF-T) have been rapidly adopted by countries in Latin America, the European Union (EU), and North America.

New technologies – including robotic process automation (RPA), artificial intelligence (AI), and Blockchain – are delivering new options for finance teams globally. To keep pace, processes and technology improvements must be examined for relevance and effectiveness.

Moving to SAP S/4HANA provides a great opportunity to reevaluate all your key business processes together with emerging requirements and new technology.

Comment From Rosa: Is there a checklist of prerequisites to be performed before and after migration to SAP S/4HANA?

Jochen Stiebe: We have more options to implement SAP S/4HANA. For the data preparation, the SAP HANA side car approach could be a great opportunity. The side car approach is perfect to do a step-by-step implementation.

Matthew Shea: What are some SAP S/4HANA terms we need to know?

Jochen Stiebe: SAP HANA is the database. SAP S/4HANA is the new ERP application on SAP HANA.

Comment From Mike: What are some of the benefits my team can expect from implementing SAP S/4HANA Finance?

Brian Shannon: Mike, your team will experience cost savings from leaner data and process definition; an improved user experience for all users with the SAP Fiori user interface (UI); and, significantly, more timely access to data for improved decision-making.

Comment From Nathan: I’m concerned about a big bang transition to SAP S/4HANA Finance. Is there a way we can start small and only use selected functionality in SAP S/4HANA Finance?

Jochen Stiebe: You are not alone with that opinion. More than 80 percent of the current implementations are based on a side car approach. This approach means that the client does not do the implementation as a big bang transition.

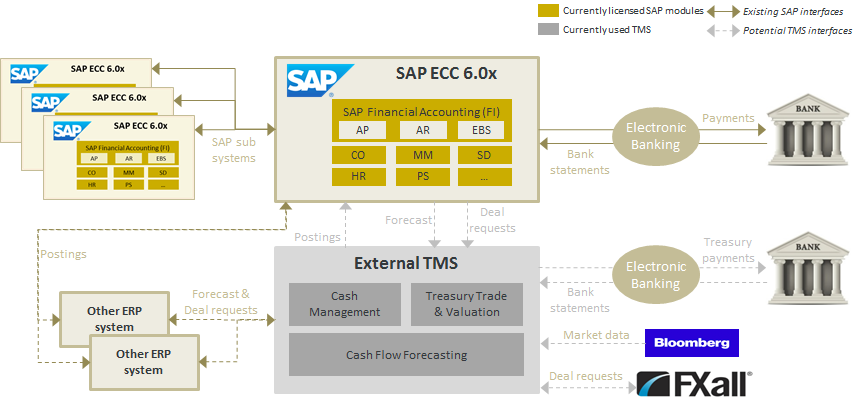

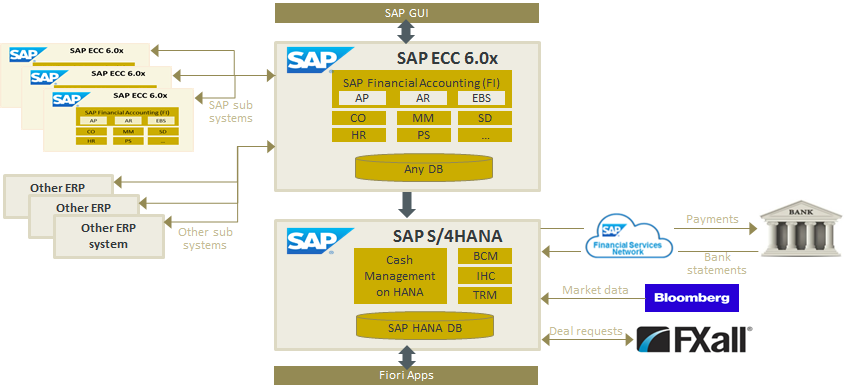

An SAP S/4HANA side car approach is a “new” term for the implementation of an SAP S/4HANA landscape based on two clients. One client is the SAP ERP client based on a traditional SAP ERP Central Component (ECC) 6.0 installation based on any database combined with an SAP S/4HANA implementation, including Financials components such as SAP Cash Management, SAP Liquidity Management, SAP Treasury and Risk Management, and SAP In-House Cash. We name it a side car approach, or SAP S/4HANA Treasury Workstation approach.

Here you can see a typical IT landscape of a client.

Here you see the side car approach. Note that the SAP S/4HANA client replaces the external treasury management system (TMS).

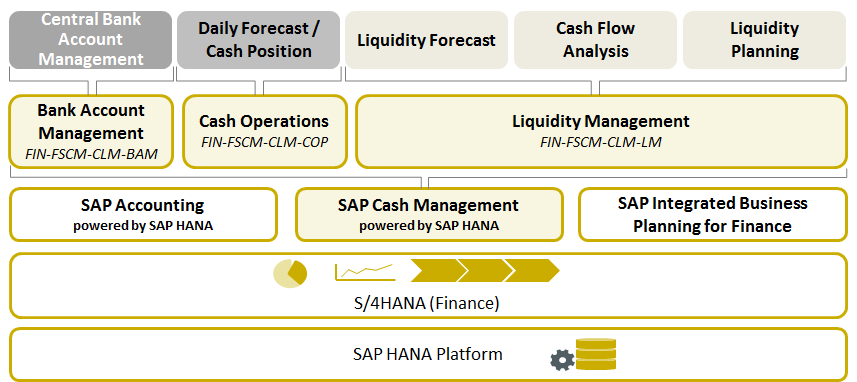

SAP S/4 HANA includes three components. One is SAP S/4HANA Finance for cash management, which is the new Treasury platform for SAP applications on SAP HANA.

Here you see the three different elements for SAP S/4HANA (Finance). Note that SAP S/4HANA Finance for cash management (formerly SAP Cash Management powered by SAP HANA) is the new Treasury-related function module.

In an SAP S/4HANA big bang you have to implement all the parts. The side car allows you to do the implementation partly.

Comment From Noel: What do I need to do to prepare my finance team for SAP S/4HANA?

Jochen Stiebe: I recommend to do an SAP S/4HANA preparation check to design a business roadmap for the implementation. Together with the IT department, we can finalize the roadmap after that.

Comment From Luiz Pecanha: Which are the most common issues and changes in daily procedures for the customer user?

Jochen Stiebe: The technology aspect and the new SAP Fiori user experience are motivating clients to go with SAP S/4HANA. From the functional side, clients like the flexibility of SAP S/4HANA analytics and reports.

Comment From Patti: What steps can companies take to prepare data in advance of a move to SAP S/4HANA? Do the activities change based on the implementation approach (new implementation, system conversion, or landscape transformation)?

Brian Shannon: Thanks for the question, Patti. SAP S/4HANA provides a high-performance database, but it can be expensive to migrate a significant amount of “static” data into the SAP HANA appliance. As such, we recommend developing an archiving strategy and limiting the amount of static data that goes into SAP HANA. You do have options available to you depending on your implementation approach, but whatever that might be, archiving is an important first step.

Comment From Patti: Can you explain some of the risks with moving to SAP S/4HANA and what steps can be taken to minimize or eliminate the risk?

Brian Shannon: Risk mitigation with respect to a move to SAP S/4HANA should be an important part of your team’s overall plan. A financial framework for SAP S/4HANA includes not just a technology roadmap (which may include best-of-breed apps within the entire SAP ecosystem) but also a well-thought-out plan for the business process roadmap. Too many organizations are letting the technology roadmap dictate the direction, and this then poses risks to efficient process transitions and optimization planning.

Collaboration and planning are keys to minimizing risk.

Comment From Mary: What are some of the most complex challenges faced by companies that have implemented SAP S/4HANA?

Brian Shannon: Key challenges we’ve seen to date are similar to ones in days gone by with SAP implementations. SAP S/4HANA is an integrated system with integrated processes. This requires exceptional change leadership from both IT and functional leaders to ensure that the organization’s visions and drivers are understood and that the deployment is smooth. Training is simplified, given the more intuitive applications, but still is an important consideration.

Comment From Niti: How does an SAP S/4HANA implementation change if we use third-party software, such as OpenText, Vertex, and Vendavo, for some of our processes?

Brian Shannon: With the move to SAP S/4HANA, it’s important to evaluate all the solutions in your SAP landscape to see if they fit with your company’s strategic vision.

There may be more modern solutions available on the market that are better suited to SAP S/4HANA. Alternately, the functionality these solutions provide could be replaced by what is available in SAP S/4HANA.

Definitely, some of these solutions will remain, others will be retired, and new ones will have to be added.

The key is to understand how these solutions fit into your business process first and then work with the IT team to figure out how to make them work in SAP S/4HANA. This is where it’s important for finance leaders to help drive the changes coming with SAP S/4HANA instead of reacting to them after they have happened.

Comment From Eddie: In terms of landscape transformation, how challenging is consolidating multiple instances and different functionalities in different systems on to SAP S/4HANA?

Jochen Stiebe: The challenge is there, which is why I recommend doing an SAP S/4HANA pre-check based on the new SAP S/4HANA platform. With SAP S/4HANA we have many more possibilities to connect multiple instances than we did in ECC. A good example is to use the SAP HANA One Exposure hub, which supports integration of multiple instances on one SAP HANA database.

Here you see SAP S/4HANA One Exposure from Operations. It is technically one table that combines different data sources for financial purposes. Similar things are possible on the SAP Accounting site.

Comment From Shrini: Could you share some scenarios or examples of how we can get leaner data and process definition and an improved user experience?

Brian Shannon: In-memory computing – the basis for the SAP HANA database – offers unparalleled speed and accessibility to data. So now applications that are utilizing robotic process automation (RPA) and machine learning have much greater computing power to manage complex algorithms. For example, the issue of fraudulent payments affects roughly three out of four organizations. Improved analytical toolsets and monitoring applications will provide immediate cost savings and risk mitigation. These apps can become an essential part of your improved processes moving forward. The user experience is enhanced with results from the monitor that are presented in more easily consumable reports and graphics.

Comment From Mary: What were some of the biggest challenges faced by companies that have already implemented SAP S/4HANA? What was the disruption to the business in terms of time?

Jochen Stiebe: The challenge will be that SAP S/4HANA is a new ERP environment and that we all collect the new experiences. The lessons learned from the last projects show us that there are a lot of constructions, especially in the SAP Accounting area. That is the reason why we normally recommend to do a side car approach. You can combine the traditional stable world in ECC with the new tested world of SAP S/4HANA Finance and get an SAP integrated finance and treasury system.

Comment From Patti: Could you share information about the amount of productivity that customers have been experiencing with the move to SAP S/4HANA’s SAP Fiori user experience?

Jochen Stiebe: This is something that I have to prepare. One thing is that the customer likes the flexibility. You have no borders and everybody can create his or her own dashboard. SAP Fiori is more than flexible.

Comment From Patti: Within the organization, where can we expect to see the largest benefits assuming the SAP S/4HANA implementation is handled through SAP Central Finance and not a greenfield implementation or system conversion?

Brian Shannon: From a technical perspective, the benefits will accrue to the data volume management components. Being able to archive data first, decommission legacy systems (including old SAP instances), and then have a much more efficient database means less latency in response time for users. From a purely finance perspective, the use of the universal journal provides greater capability in meeting statutory responses. A true “single source of truth” is enabled with a consolidation of the numerous supporting tables for Financial Accounting (FI), Asset Accounting (FI-AA), Controlling (CO), and Profitability Analysis (CO-PA) into a single table structure. The result is much better, more confident financial reporting than you get with standard SAP ERP systems.

Finally, improving core processes such as Accounts Receivable (AR) and Accounts Payable (AP) becomes more straightforward with best-in-class solutions and apps that can readily deliver value. Taking these key cash processes from just “automation” to optimization becomes easier now.

Comment From Jan: In your opinion which new analytic tools have been most embraced by finance users?

Jochen Stiebe: There are analytic tools available to do real-time analytics with flexible filters and criteria. The customer can create these analytics on the fly.

Comment From Guest: What do I need to define if my company is ready for a transition from ECC 6.0 to SAP S/4HANA Finance plus SAP S/4HANA Supply Chain 1610? To identify where we are and where we need to go, what are best practices or recommendations to conduct a very productive assessment?

Jochen Stiebe: We created a special SAP S/4HANA assessment based on a pre-questionnaire and an on-site workshop with the business and the IT department. Based on the requirements and based on the IT landscape and strategy, we prepared together with the client an SAP S/4HANA roadmap and discussed the different deployment options.

Comment From Som Perla: Brian, you mentioned RPA and AI. Please give examples of use cases where these technologies were used for significant benefits in financial processes?

Brian Shannon: Thanks, Som. RPA capabilities in the capture of information from inbound documents – such as AP invoices or AR remittance advice documents – now provide much greater insight into the “back story” of the transaction. For example, being able to access sales and distribution (SD) document flow documents can help provide insights into the probable cause for disputes, provide intelligent routing for disputes, and even propose actions (prepare a credit memo or debit memo) with communication to the customer. It is about learning the behavior of the process and using that knowledge to automate processes and decisions.

Comment From Eddie: What do you mean by a side car approach? Is it a controlled rollout per region?

Jochen Stiebe: No. The side car is an architectural model for the SAP S/4HANA implementation. Normally, SAP S/4HANA is the central system. Further rollouts are not typically required.

Comment From Kewal: How do I to take advantage of the multiple currency feature in SAP S/4HANA Finance?

Jochen Stiebe: The multiple currency feature helps you perform different kinds of analytics. The flexibility of the SAP HANA database enables you to create individual views to manage the multiple currencies of a company.

Comment From Mary: For SAP S/4HANA, what methods are companies using to train users on new functionality?

Brian Shannon: Hi, Mary. Companies are using shorter, more digestible media for training – for example, the use of short videos is very popular. Throwing in a little humor doesn’t hurt. Some are still using the old classroom method, but this is on the decline. What is really important is having “ownership” of the solution internally and ensuring that your trainers are speaking the language of your organization – whether that is via webex, in a classroom, or on a video.

Comment From Deb Trimble: What improvements will we see in SAP S/4HANA with regard to AP and AR?

Jochen Stiebe: The AP and AR processes are completely renewed and based on the SAP S/4HANA developments, the client gets new opportunities in the handling of AP and AR.

Comment From Niti: How long does a typical SAP S/4HANA implementation take?

Brian Shannon: Hi, Niti. Here is the best consultant response I can think of. It depends. But really, it does depend on factors such as your approach (migration versus greenfield), the state of your current business processes, and the desire to reinvent your key processes.

But one thing that can be reduced for certain is the migration of data. Many of our customers did significant data management tasks before moving to SAP S/4HANA to help smooth the transition. All saw significant improvements in the time it took to make the migration and a reduction in the cost for the migration. Here are three examples:

Dr Pepper Snapple Group

https://www.dolphin-corp.com/presentations/2017_ASUG_SAPPHIRE_DPSG_HANA.pdf

LANXESS (formerly Chemtura)

https://www.dolphin-corp.com/presentations/2017_ASUG_Sapphire_Chemtura_S4HANA.pdf

ABBVIE

https://www.dolphin-corp.com/presentations/2017_ASUG_SAPPHIRE_AbbVie_HANA.pdf

From a usability perspective, definitely the SAP Fiori apps have helped companies adopt significant process improvements quickly across the organization. You can also implement many SAP Fiori apps before you actually move to SAP S/4HANA, although you need to consider the impact of the change to your organization.

Jochen Stiebe: Based on the answers before, it is it difficult to definitively answer for a big bang SAP S/4HANA implementation. Our experience with the SAP S/4HANA side car implementation shows that a normal implementation can be done between three and six months based on the modules that have to implemented on the SAP S/4HANA platform.

Comment From Eddie: Are there any submodules that SAP S/4HANA does not support?

Brian Shannon: Hi, Eddie. One important change affecting submodules is the move to business partners from the pure vendor and customer master records of before. SAP Foreign Trade/Customs is now SAP Global Trade Services. SAP Revenue Accounting and Reporting has replaced the old SAP SD Revenue Recognition element.

Comment From Guest: Is a new general ledger (G/L) technical upgrade still required to migrate from ECC 6.0 to SAP S/4HANA?

Jochen Stiebe: The answer depends on your custom codes. We developed a special technical pre-check for the G/L to ensure it is ready for migration. Generally, we recommend implementing SAP Central Finance first. But at the end it depends on your setup. Always do a pre-check to clarify this without doubt.

Comment From Eddie: Could you explain how SAP Financial Supply Chain Management (FIN-FSCM) integrates with SAP S/4HANA, or is it called something else now?

Jochen Stiebe: The parts of SAP FIN-FSCM (biller direct, collections and dispute management, credit management) are not rebuilt in SAP S/4HANA. These modules and the other SAP Financials modules, such as SAP Treasury and Risk Management and SAP In-House Cash, are only enabled for SAP S/4HANA. Therefore, these modules are linked to SAP S/4HANA, but are not newly created. These modules use the SAP Fiori user interface; therefore, these modules look new, but they are not. They are only easier to view than the old FIN-FSCM modules. The underlying functions are the same. The link with SAP S/4HANA runs without problems.

Comment From Mary: Is it possible to implement a business partner in ECC 6.0 in an effort to save time later on during an SAP S/4HANA implementation?

Jochen Stiebe: Yes, that is possible.

Comment From Patti: What role does Dolphin play in migrations to SAP S/4HANA? Is it focused just on archiving or are other services available, too?

Brian Shannon: Hi, Patti. Dolphin has deep experience with managing data from a variety of source systems and capturing that data in a system-agnostic way to enable organizations to sundown expensive legacy systems while preserving audit requirements. Rapid archiving solutions are available not just to support a move to SAP S/4HANA but also to meet other data management needs such as carve-outs for organizations going through mergers or acquisitions.

Finally, we can help you to further automate and optimize your core finance and treasury processes to ensure the yin and yang coexistence of your data and processes.

Comment From James: Do the SAP S/4HANA and SAP Fiori apps contain all the functionality of the GUI transaction from ECC?

Brian Shannon: Hi, James. I think it is likely fair to say that there are still SAP Fiori apps that are a work in progress for specific transactions. SAP continues to roll out new functionality with each new version of SAP S/4HANA.

Comment From Eddie: Are there any subledgers that SAP S/4HANA Finance does not support yet? At one time Simple Finance did not have Fixed Assets functionality?

Jochen Stiebe: Yes, you are right. SAP S/4HANA Accounting is new, and to be sure that all your requirements can be covered, I recommend that you do a pre-check of the business and technical prerequisites and requirements.

Comment From Mary: What about for greenfield implementation time?

Brian Shannon: Hi, Mary. Greenfield again depends on your organization and scope of your project. We are working on one now that is nine months to the first phase, but over 18 months in total. The client is doing a complete redesign of its order-to-cash, procure-to-pay, and record-to-report processes.

Matthew Shea: Would you like to leave us with any other information about how to build a financial framework for SAP S/4HANA?

Brian Shannon: It’s important to build a financial framework that creates a unified vision for SAP S/4HANA.

Use SAP S/4HANA Finance as the digital core and then evaluate your current landscape and build best-of-breed solutions around it to add essential business functionality.

Make sure you have a process roadmap to explain how critical business processes will work across this new landscape.

Most importantly, don’t try to do everything at once. Implement the foundational components you will need first so that you can quickly deliver value to the organization. Examples of foundational components include core finance components and technology integrations such as electronic data interchange (EDI) that will be necessary to complete transactions.

From there, add to the financial core with broad capabilities such as cash management and cash reporting. Once that step is complete, you can begin to implement more specific finance functionality that you will need.

Finally, don’t forget to support these changes with an information management strategy. Financial transactions generate large volumes of supporting documents and data that must be retained for long periods. Putting an information management strategy in place early on will ensure that your financial data is retained securely and that it is easily accessible to users when it is needed.

While the lightning-fast, columnar SAP HANA database makes it possible to keep large volumes of data in productive systems, a significant percentage of the data is static and should not be moved to the new system. Archiving will enable you to continue to report on this older data without taking up valuable space in the new system.

Consider retiring legacy applications whenever possible. This step will not only enable SAP S/4HANA to become the single source of truth for all enterprise financial data but also help reduce risk, reduce costs, and reduce the time and effort for responding to queries.

Meet the panelists:

Brian Shannon, Dolphin

Brian Shannon, Dolphin

As Dolphin’s Chief Strategy Officer, Mr. Shannon is focused on business processes and financial solutions to maximize return on investment. He has more than 20 years of SAP experience and his background includes thought leadership, knowledge management, project management, training and SAP consulting with extensive experience in the automotive and manufacturing sectors as well as oil and gas, retail and utility verticals.

Jochen Stiebe, SymQ GmbH

Jochen Stiebe has more than 17 years of experience in the area of Cash, Treasury and Risk Management for industrial, trading and energy companies as well as for banks and asset management companies. His consulting focus lies both on the realization of SAP-based solutions and on designing and implementing alternative system designs in existing SAP system landscapes. As Managing Director he is responsible for all business segments of SymQ GmbH, a member of the Hanse Orga Group.

Many companies are eager to move to SAP S/4HANA Finance to take advantage of the in-memory platform’s improved capabilities and real-time reporting. However, it is important to ensure your data and processes are ready to take full advantage of what SAP S/4HANA Finance has to offer.

Read the transcript of the discussion with Dolphin and SymQ experts to learn how the finance department can build a roadmap for an integrated financial platform. They shared tips and best practices for how you can reduce risk and improve your return on investment in SAP S/4HANA Finance, answering 30 reader questions, including:

- Is there a way we can start small and only use selected functionality in SAP S/4HANA Finance?

- What steps can companies take to prepare data in advance of a move to SAP S/4HANA?

- Hw challenging is consolidating multiple instances and different functionalities in different systems on to SAP S/4HANA?

- Can you share RPA and AI use cases where these technologies were used for significant benefits in financial processes?

- For SAP S/4HANA, what methods are companies using to train users on new functionality?

- Is a new general ledger (G/L) technical upgrade still required to migrate from ECC 6.0 to SAP S/4HANA?