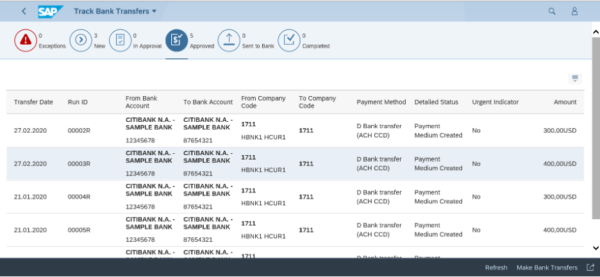

Explore the Benefit of Using Fiori APP for Incoming Customer Payments in SAP S4/HANA

by Srinath Gogineni, Asc Director SAP Application Management, FICO, Astellas Pharma Inc.

Download the demo version of this article.

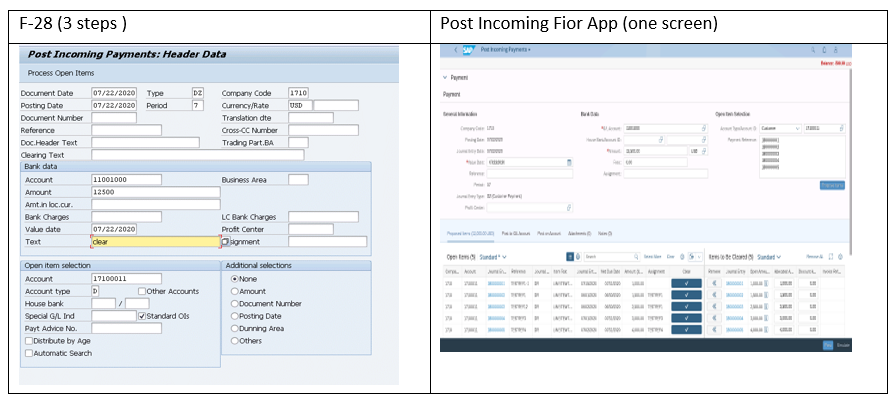

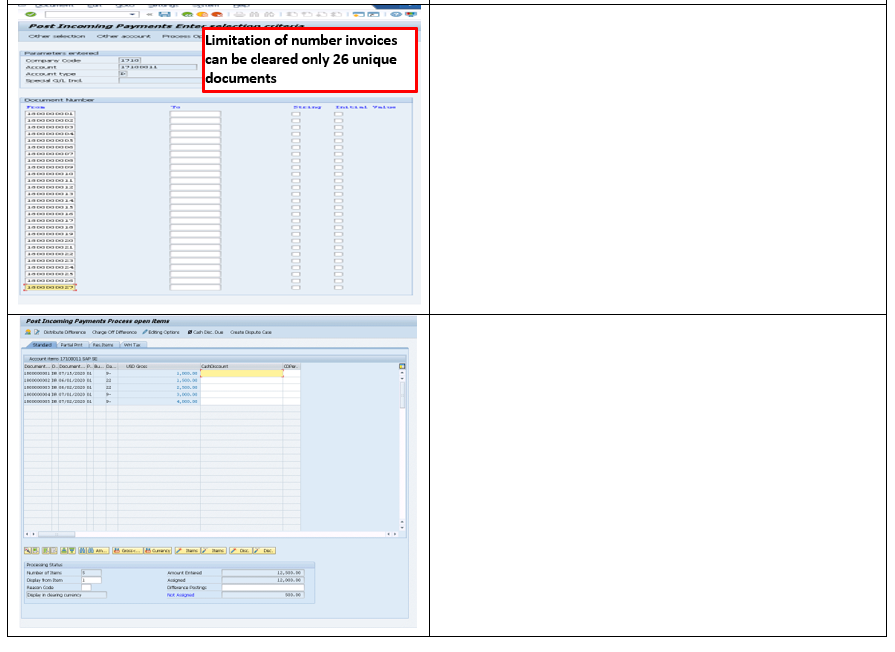

Lot of times while applying cash to customers manually and if we need to have several invoices to match the open items and clear this app will help in that process. We do have the traditional transaction code F-28 which can used for clearing the open items against the payment received or can use FB05 post against clearing but the time it takes for processing if we have several invoices it has a limitation of 27 invoices at a time to clear and number of steps involved in this process to clear will take time. But with the Fiori app for post incoming payments and to clear open items of around 100+ invoices it will just take few seconds. The limitation in Fiori app has 110 invoices at time can be cleared.

Please Note:

This article mainly focuses on the process of clearing several invoices against the incoming payment using Fiori app. This is app is not intended to replace the F-28 transaction code process because F-28 still offers lot more additional functionalities which this App does not provide. So, suggestion is to use this App if you need to process several invoices at one time in much quicker and easier way.

Learning Objectives

The scope of this article is to explain the functionality for using the Post Incoming Payment Fiori app feature available from 1511 SAP S4 Hana on Premise. In addition, configuration required for setting up the parameter for matching through document number and reference numbers for auto match and clear. The scope of this article does not include the functionality of how to activate the Fiori app itself, this should be worked with the technical Fiori app consultant.

In the following steps let’s see how we can achieve this through configuration and then I will proceed to show the document posted using the Fiori App Post Incoming payment.

Remember the configuration is a prerequisite for the Fiori app to work otherwise the system will not be able to match the document numbers or reference numbers to clear the open items.

Configuration Steps

In order to match open items based on the payment information like reference number or document numbers we must define rules for these payments. This app work like the electronic bank statements unlike F-28 while searching the data for matching by document number or reference number. The following are detailed steps for the configuration of the posting parameters.

Step 1:

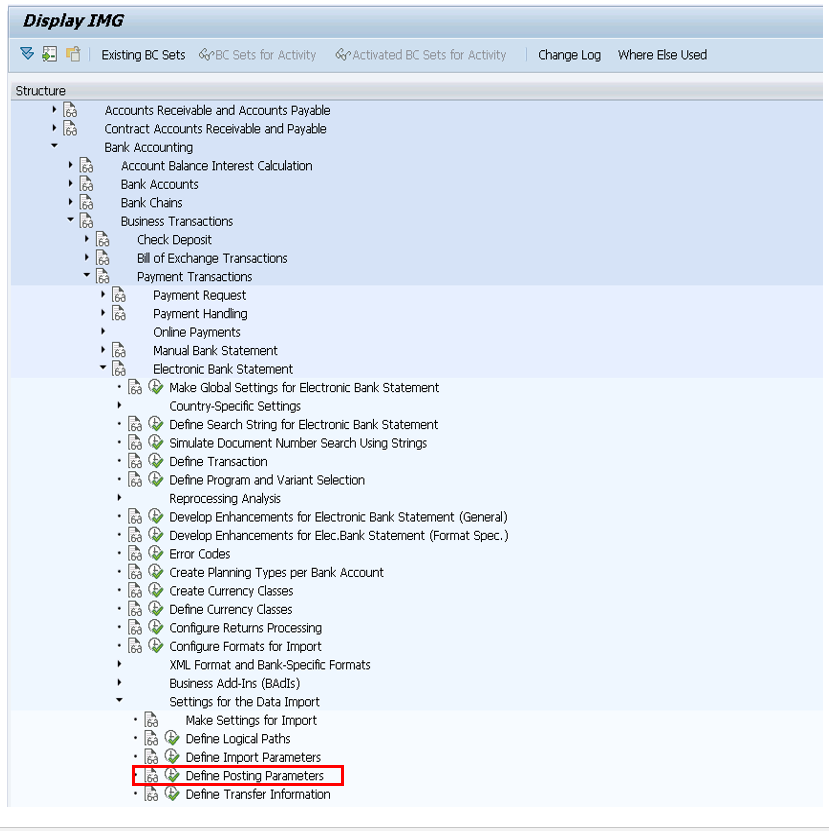

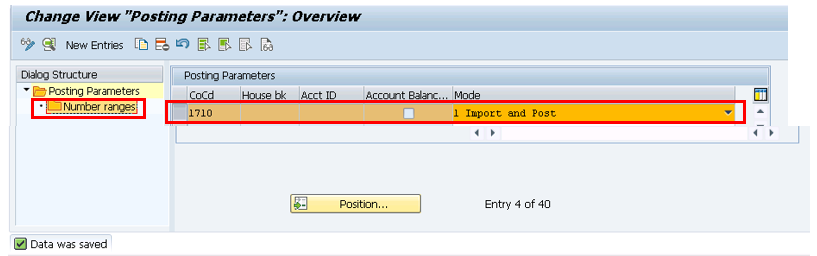

Financial Accounting under -> Bank Accounting -> Business Transactions -> Payment Transactions -> Electronic Bank Statement -> Settings for the Data Import -> Define Posting Parameters .

We can define entries for each company code. If you need rules on a more detailed level, you can also make settings for different house banks and account IDs.

But for the regular clearing purposes for the incoming payments from customer we don’t need to setup by house bank ID and account ID for auto matching and open item clearing purpose. Please see below how the setup has to be at the company code level only.

Figure 1—Define posting parameter screen

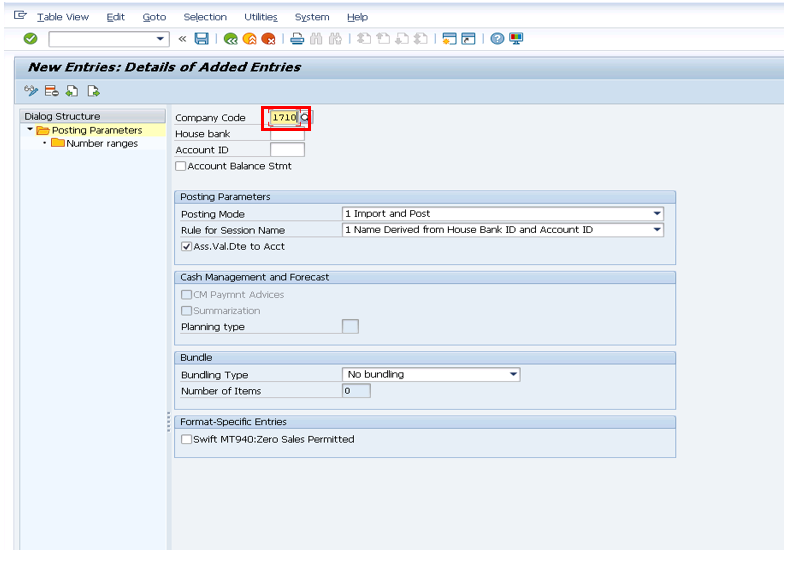

Then Click on New entries and Figure 2 will appear as shown below.

Enter company code 1710 do not enter house bank and house bank ID (reason this can be broadly selected at the company code level irrespective of the house banks ) as show below all other parameters shown on the below Figure 2 screen shot are defaulted by the system.

Figure 2—New entries for posting parameters

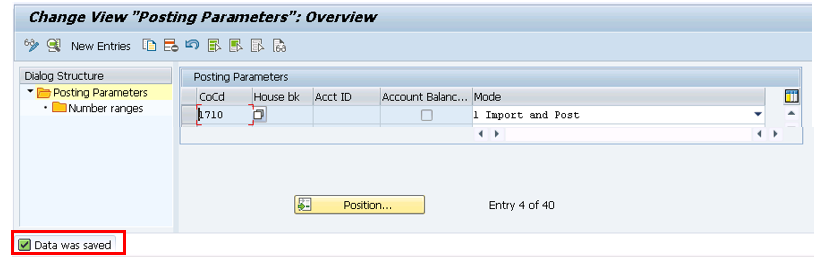

Then hit enter and click save icon and posting parameter saved screen shot will be displayed with data saved for posting parameters (Figure 3).

Figure 3—Posting parameters saved

Step 2:

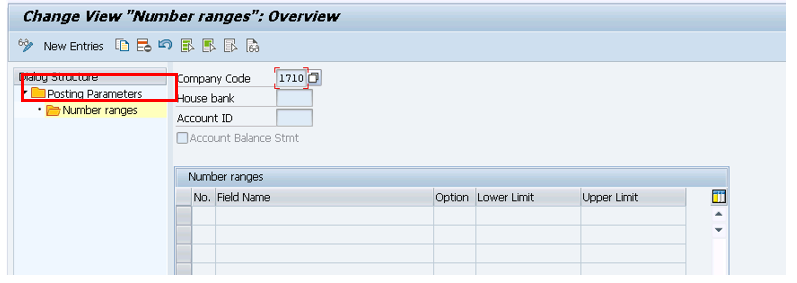

Once the step 1 is defined we need to define number ranges in step 2.

Highlight the row for the company code as shown in Figure 4 and double click on Number ranges icon under the posting parameter and Figure 5 screen will appear.

Figure 4—Number ranges selection for company code

Figure 5—Number ranges for entry screen

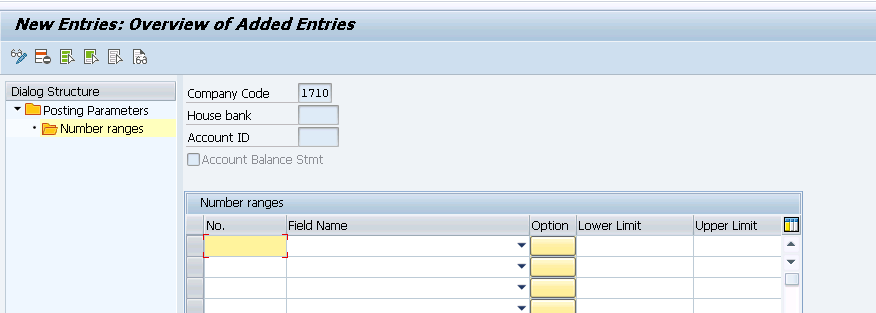

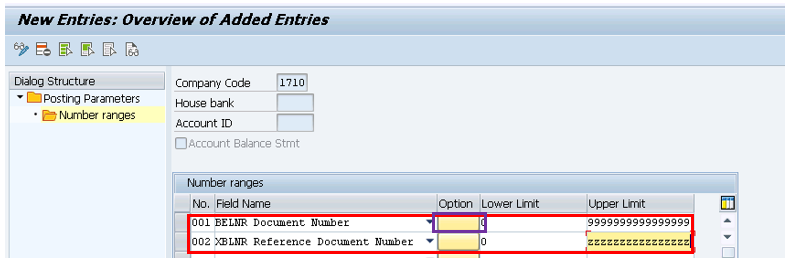

Then Click on New entries icon and Figure 6 will appear as shown below.

Figure 6—Number ranges data entry with field name appear

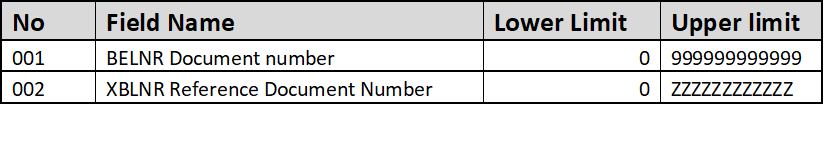

Please enter the parameters as show below on the screen Figure 7.

Please note only we have two fields name provided by SAP now as you can see one is document number (BELNR) and another one is Reference document number (XBLNR).

Figure 7—Number ranges details entered

Do not click on Option button until you have entered the Lower limit and Upper Limit as shown in Figure 7, otherwise system will not show the option of Range.

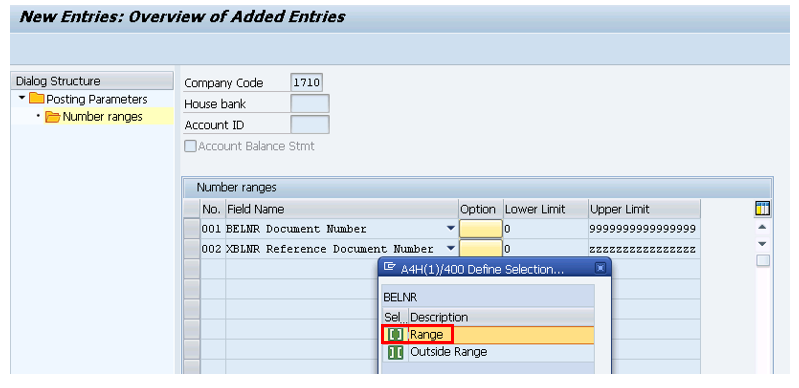

Now click the option button now. System will bring the option Range as shown below in Figure 8.

Figure 8—Number ranges Range selection

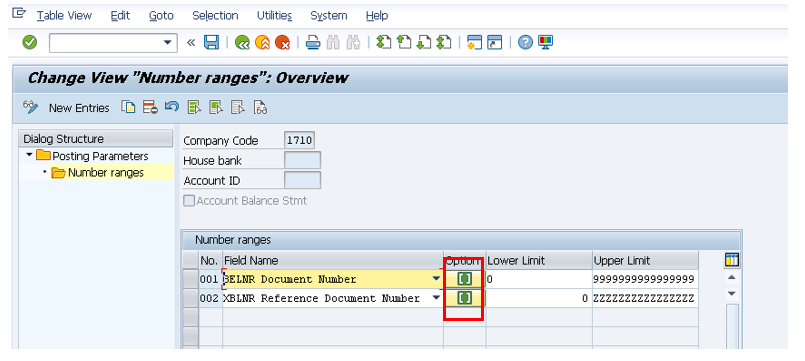

Just double click on Range Icon system will select the option as shown in Figure 9.

Figure 9—Number ranges Range selected

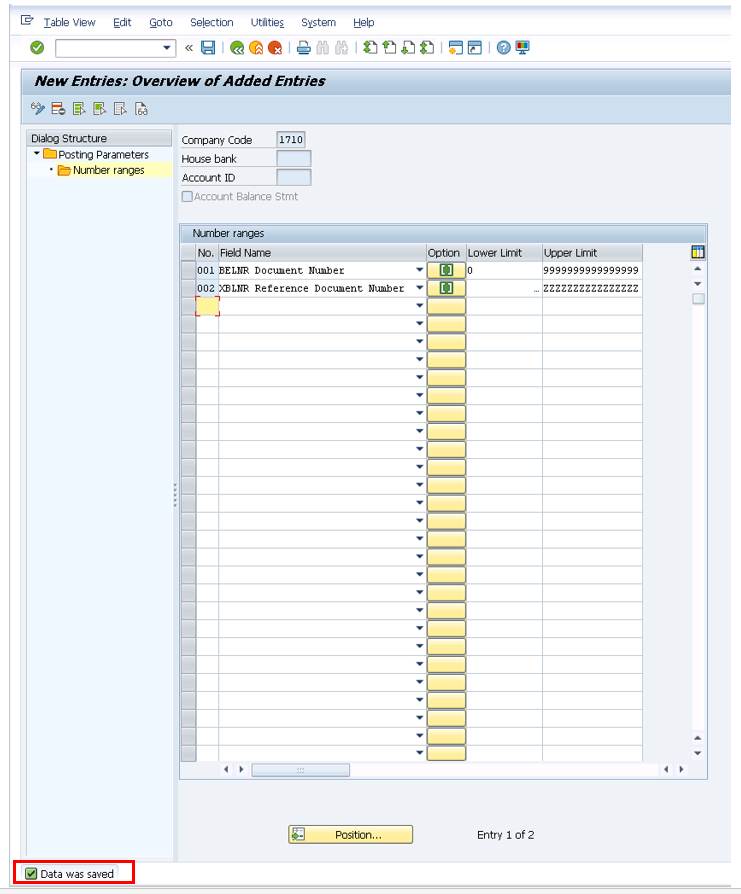

Now click the save icon and data will be saved as shown in the Figure 10.

Figure 10—Number ranges saved

With simple above two steps the configuration part is done now. Now lets us proceed to use the Fiori App Post Incoming payments.

Step 3:

Using Fiori App Post incoming Payments.

Prerequisite the Fiori App should be active by the technical team and the scope of this document is not to cover that part but only the usage of this app is covered in following section.

Double click on the Fiori app Post Incoming Payments as shown Figure 11.

Figure 11—Post Incoming Payment Fiori app

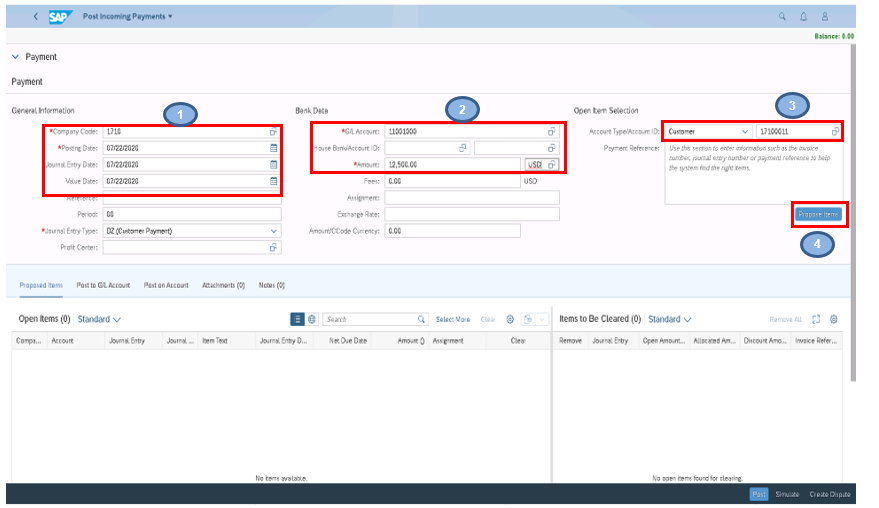

Following Figure 12 screen will be displayed.

Figure 12—Post Incoming Payment Fiori app parameter screen

Enter the parameter as shown above in Figure 12 each number corresponds to the fields mentioned below

- Enter Company code, Posting Date, Document entry date and values date

- Enter GL account, Amount and currency

- Enter customer number

After entering all the parameter click on the button Process items section 4 of Figure 12.

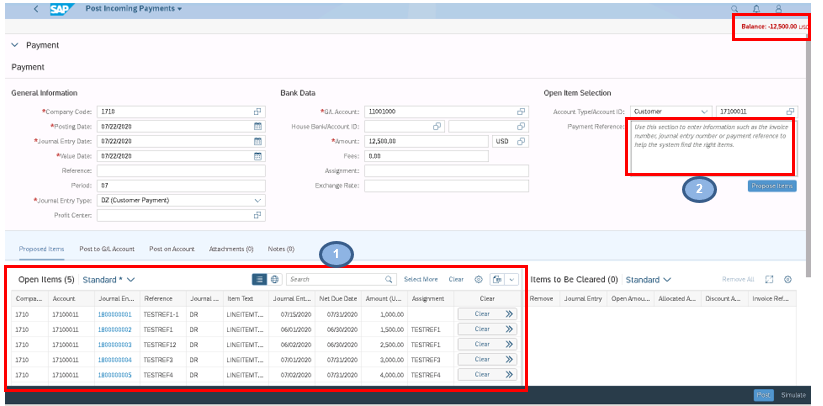

The following Figure 13 will appear as you can see the bottom system will bring all the open items of the customer highlighted in section 1.

Figure 13—Post Incoming Payment Fiori app with open items

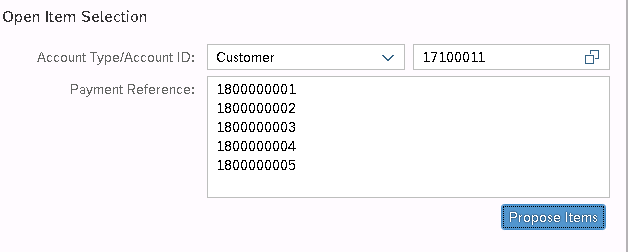

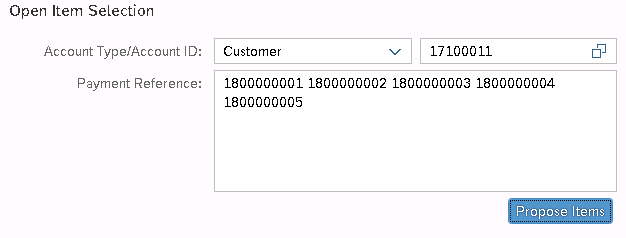

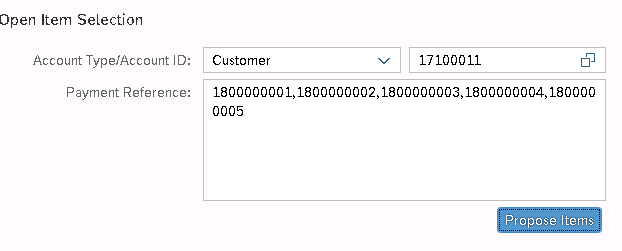

Next step enter in section 2 of Figure 13 we need to enter the document numbers in the payment reference section as shown below in detailed manner of figure 14,15 & 16. As we can see below 3 different options, I have given any of the one work the same way for match the document numbers which needs to be cleared. The best way is to download the list of open item items and pull the document numbers relevant for this clearing and keep it in note pad or excel. The simply paste it in the payment reference text box. The reason I suggest to use the document number is because unique. As we have seen in Step 2 of Figure 7 only document number and reference number can be used in this payment reference text box. As I have mentioned at the start of the article, we have paste around 110 document numbers maximum at a time to clear.

Figure 14—Entering payment reference numbers option 1

Figure 15—Entering payment reference numbers option 2

Figure 16—Entering payment reference numbers option 3

Once you have entered the Payment reference in either options as shown above then click process Items button.

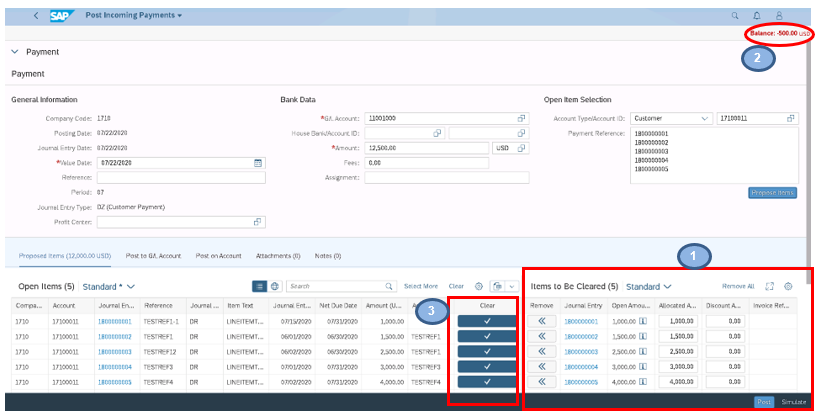

Then the following screen will appear as shown in Figure 17 Items to be cleared section 1 on the right hand side and also we can see still a balance of 500 is left as highlighted at section 2.

Figure 17—Items to be cleared screen

As we see the tab of Clear section 3 of the above Figure 17 changed from Clear>> of which we have seen in Figure 13 to check mark in Figure 17. This means the items are matched and moved to the next section. In above example all the item is match and moved to the section. But we could still have some open items with Clear>> as identifier. My manually clicking the button will move the items to the items to be cleared section. We could have this scenario where certain items we need to manually match the we can use this option.

Now let’s look at option of how to adjust the 500 credit. We have two options

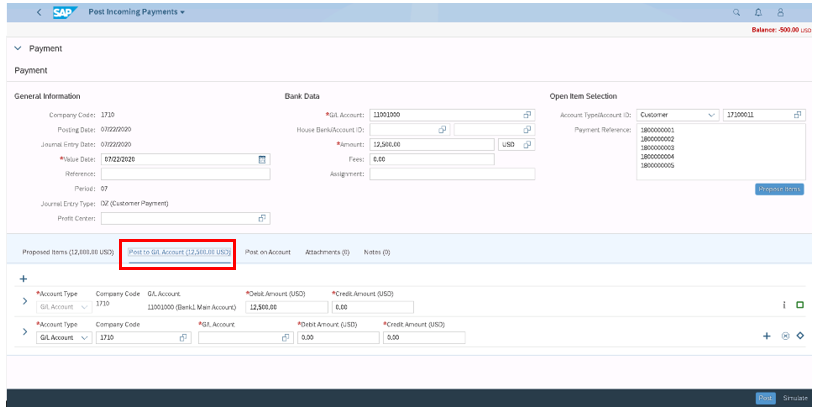

Either to post to a GL account as shown below in Figure 18 – Option 1

or to post on customer Account as shown below Figure 19– Option 2

In this example I will go with option 2 post on customer account.

Figure 18—Post to GL Account

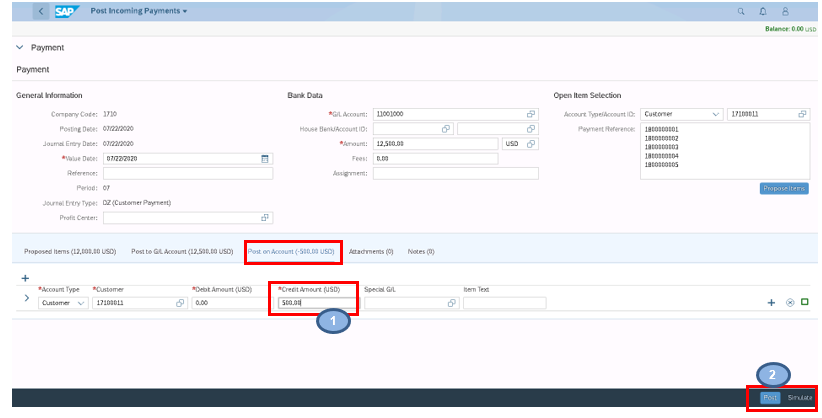

Click On Post on account tab as shown below in Figure 19 Enter the amount 500 as mention in point 1.

Figure 19—Post on Account

Then click button to post simulate if any error is there if not then click the button post as highlighted in section 2 of Figure 19 post on Account

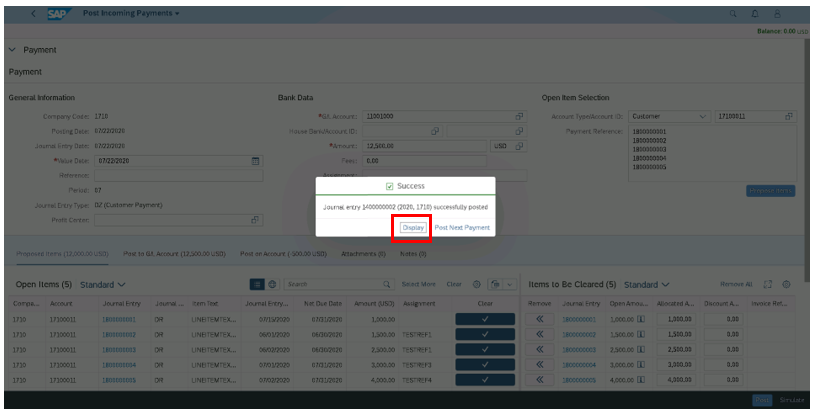

Then following Figure 20 will appear with the message Journal entry posted.

Figure 20—Document posted screen

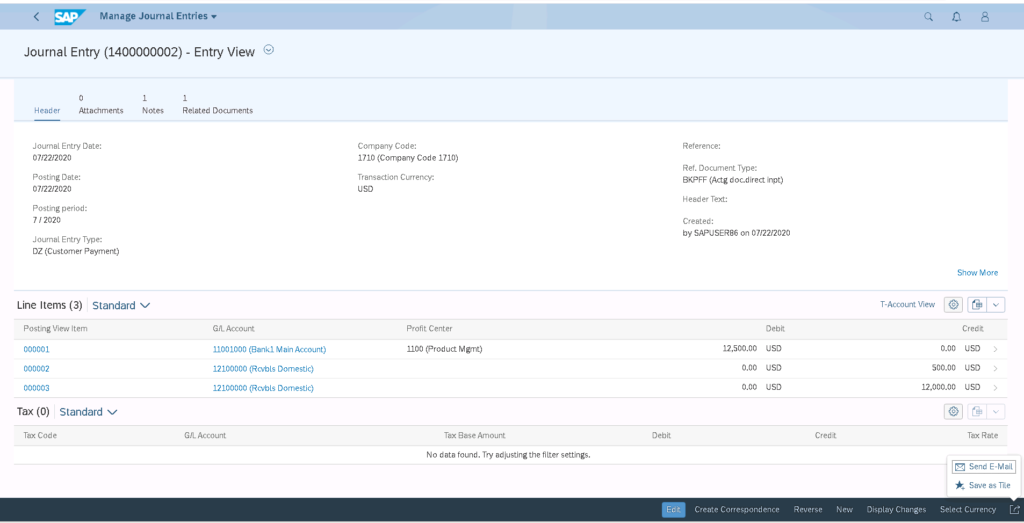

You can click the display on the message of the document as shown in Figure 20 of document posted screen to display the document and it will be displayed as shown in the following Figure 21.

Figure 21—Document display after posting

Thus as we can see as mentioned above how simple it was to post incoming payment for customer and clear the number of invoices all in one screen with just pasting document numbers.

Let just see the process and steps if we use F-28 transaction codes. I am just highlighting only the steps here at high level only and my intention in this article is not cover in detail how F-28 works.

Figure 22—Abbreviated steps for using F-28 transaction codes (1 of 2)

Figure 23—Abbreviated steps for using F-28 transaction codes (2 of 2)