RISE with SAP – Engagement Hosted by Software One

Meet the Experts

Key Takeaways

⇨ Learn about what is driving interest in RISE with SAP

⇨ Explore the role of ERP and innovation in organization's plans

⇨ Understand how organizations are selecting a hosting partner for RISE with SAP

In this on-demand webinar:

RISE with SAP is the cornerstone of SAP’s cloud ERP strategy. Released in January 2021, the offering has evolved from a licensing bundle built around SAP S/4HANA Cloud to a solution focused on driving business innovation and the tools to achieve it. While the overall makeup of the solution has not changed significantly in the last year, there is now greater emphasis on supporting new business models, improving process efficiency, and modernizing critical systems without disruption.

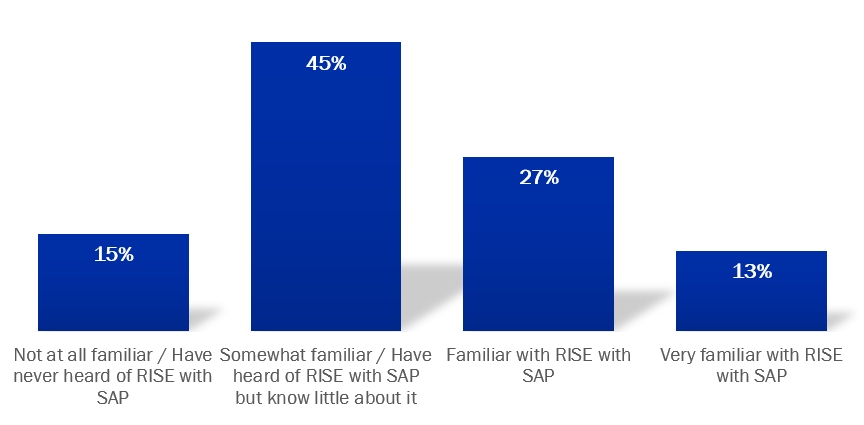

But a significant number of organizations are at most somewhat familiar with the solution (Figure 1) even though it has been at the forefront of SAP’s marketing for most of the last two years. This suggests that, while organizations are hearing about RISE with SAP, many still only have a basic understanding of the solution.

Explore related questions

Figure 1: Familiarity with RISE with SAP

Tune into this on-demand webinar to review the full data analysis from 282 members of the SAPinsider community and receive recommendations for your own plans.

- Learn about what is driving interest in RISE with SAP

- Explore the role of ERP and innovation in organization’s plans

- Understand how organizations are selecting a hosting partner for RISE with SAP

- See what you need to do be ready for innovation

Webinar Sponsors:

Read More:

Robert Holland (00:00:00):

Hello and welcome to today’s webinar, rise with s a p Engagement, hosted by S A P Insider and presented by Capgemini, Google Cloud, Microsoft Azure, red Hat, and Software one. I’m Robert Holland from S a p Insider. So, just a couple of short announcements before we begin. Uh, after the presentation, I will answer as many questions as time permits. Uh, please submit your questions using the q and a panel, uh, at the bottom of the Zoom window. Uh, you will have a copy of today’s presentation provided to you via email after today’s session. Um, and if we don’t get to any questions, uh, we will follow up with them after the fact. So let’s get on with this. Um, firstly, let me sort of start off by saying that this is different than the Rise sap webinar, uh, research report findings that I presented about a month ago in, in December.

(00:00:54):

Um, this is focused. There were some questions that we had, uh, uh, in across both surveys that we did, uh, for both reports. Um, some of them we aggregated the data across both reports in order to provide a deeper insight. We had, uh, a larger number of respondents that way. Uh, but there were some questions that we didn’t touch on in the first report. And, um, those are some of the questions that I’m gonna be discussing in the first part of the research today. So, um, for those of you who, most of you’re probably, or many of you’re probably familiar with our, the way we present our research findings here at S A P Insider, um, but, uh, we, we, we focused our research on respondents that were involved, uh, in E R P and architecture decisions at organizations that are part of the S A P Insider community.

(00:01:48):

And we surveyed these members about their plans for RISE with S A P and how that correlates with their plans for E R P and innovation. Um, the object of the research, obviously, is to determine their familiarity with rise with s a p, um, uh, to advance the slide, um, uh, you know, and, and what factors that are sort of in rise by SAP that are of most interest to them. So we sort of talk about the drivers, the actions, the requirements, and the technologies on which they’re focused on. Um, which we, we did touch on a little bit in the previous, uh, research findings, but there’s a slightly different emphasis this time around. So, as you can see, because we aggregated some of the data for, for some of the questions we had, we’re looking at nearly 300 respondents. Uh, who answered this se these surveys between August and November of 2022.

(00:02:40):

Um, there were, we also talked to, um, some in, in post, um, post survey interviews. We had a few conversations. Um, but what was notable about this particularly, um, the second survey we had in the field is that the large group of respondents were from North America. So 53% of the respondents that answered these surveys were from North America. Only 30% were from amea, 11% from a pj, and 6% from, um, Latin America. Now, in terms of the role they had in the organization, and this is something that, uh, I think is a little bit different than, uh, what we had is that, um, 39% of respondents identified themselves as being from IT management in their organizations. 29% said they were with the S A P teams. So they’re in some sort of role related to S A P in their organization. Um, 10% were from some sort of systems implementation or integration team, 8% from IT ops, uh, 4% from finance or accounting.

(00:03:52):

Um, business development sales was 3%, uh, 3% said they were in some other roles. We also had a, a couple of respondents from security or G R C, uh, the basis or administration team or the marketing or strategy team. Um, in terms of the, the, the, uh, industries that these respondents came from, um, we had, uh, 30% from the industrial sector. So that’s manufacturing, agriculture, energy, and natural resources. Uh, 21% were from software and technology. Some of them might have potentially included, included, uh, uh, consultants and implementation companies. Uh, 13% were from retail distribution and consumer package goods. We had public sector respondents, healthcare and life sciences, financial services and insurance, uh, media and entertainment and hospitality, transportation and travel as the other market sectors that were represented. Now, something that we did go into, uh, and there’s a couple of slides in this presentation that, um, where I signi where I do talk about the, the size of the, um, the organization that’s responding, because quite a bit of the data in here is interesting, and it’s driven by the size of the organization.

(00:05:10):

Um, so as you can see, um, approximately, you know, we, we really, we asked respondents to sort of group their organization into, based on the, the revenue of their organization in the last financial year. Um, and as you can see, about 40% of respondents said their organization had revenues over 2 billion. Now, this is what s a P would typically consider large enterprise. Um, 10% said they, they, they didn’t know, or perhaps they just did not want to provide a number. Uh, and then they leaves 50% of the respondents, um, whose organization is, has annual revenues below 2 billion. Um, you know, a good number of those are from, you know, nearly 20%, or from 500 to 2 billion, 500 million to 2 billion from 50 million to 500 million is another 16%. But basically, if you think about this, 50% of the respondents were revenues below 2000000040% were above 2 billion. And then that, that 10% unknown, and that will be of interest when we talk about some of these different data points.

(00:06:20):

So the first thing we sort of did is we wanted to gauge people’s knowledge about Rise with s a p. Um, and there’s a little bit of a regional breakdown in this as well. So pretty much, I mean, it’s changed a little bit from last year. And this isn’t necessarily identical to, you know, what people are seeing with, um, with the sum of findings that have been done by, uh, some of the different user group organizations, which sort of indicate a much higher lack of familiarity with, uh, rise with S a P. But that could be because as you remember, a good proportion of our respondents are either on the s a p team or in IT management. And these are probably the people that are more likely to be actively working with, um, s a P account executives, um, working with the S A P contacts at their organizations.

(00:07:17):

So, you know, there’s definitely a, um, I think there’s a, there’s still, as you can see, 40, nearly 50% saying they, they’re only somewhat familiar with the solution, but we are not sort of seeing those numbers where, you know, 20, 30, 40% of respondents saying they’ve never even heard of Rise with s a p. Partly I think this is because s has continued to push its message over the last 12 months. Um, but also I think it’s because of the respondents who are taking this survey. Um, someone who’s maybe an UP developer, for example, at an organization probably isn’t gonna be focusing on Rise with S A P. Whereas someone who’s, um, a lead IT leader, um, you know, may well be much more aware of, of the, of the, um, of the solution. Now, you know, we do see nearly a quarter of respondents saying they’re familiar with Rise with S A P, but only 13%, uh, are saying that they’re very familiar with Rise with s a P.

(00:08:21):

Um, and that’s basically, um, now, you know, from this point on in the survey, those who said they were not familiar or had never, sorry, who had never heard of Rise with s a p, we pretty much just asked them the demographics questions at this point. We eliminated them from the survey, um, because we did not think that their responses would be relevant to a survey about Rise with sap, um, breaking that down by region. Um, you know, the data from Latin America, because we only had a relatively small number of respondents from there. That does sort of, we do sort of consider that somewhat anecdotal. I don’t know that the 46%, uh, who said they were familiar with Rise with a is necessarily reflective cuz you noticed that it sort of tracks reasonably well. Um, you know, compared to the, the overall survey group.

(00:09:13):

Um, those in AMEA interestingly are, you know, much higher percentage, 37% say they’re familiar with Rise with S A P. Um, but those from North America have a much higher percentage saying they’re very familiar with Rise with s a p. Um, you know, so that’s, that’s sort of interesting. So those who are familiar are more likely to be very familiar from North America. And this is probably based on the interactions that they’re having, um, with their account executives and, and with their s a P teams. Um, what is also interesting is that if you look at, um, the size of the organizations in, in terms of their familiarity with Rice, with s a p, so for example, organizations that are bigger, so they have revenue above 2 billion, um, they’re more likely to be familiar with Rise with s A P. And this probably makes sense because s a P is probably, um, more aggressive in its conversations with some of these organizations because they, they want them, um, possibly many of these are not already running S A P S for ha uh, as we know that there’s approximately 30 to 35,000 enterprise E R P customers at S A P who have not yet moved to S A P SRA HANA, or not yet licensed S A P SRA hana.

(00:10:36):

Um, and many of those are probably larger organizations because we know from some of the numbers that s SAP P has, um, SAP P has discussed that, uh, a lot of the organizations that are have adopted SAP s a is for HA today are small enterprise. So those with, uh, small medium enterprise, so those with revenues below 2 billion. Um, so it is probably in it, it probably makes a lot of sense that larger organizations are more LI or people from larger organizations are more likely to be familiar with Rise with s e p cuz they’ve been looking at it to sort of see how it fits into their plans for E R P, how it puts fits into their plans for S A P esra.

(00:11:24):

Um, now, um, you know, if we look for example, at, if we sort of drill down a little bit into the, into the different components that make up the rise with SAP solution, um, and the way that this chart is organized is that, uh, it’s ranked left to right based on, uh, organizer or respondents having at least an intermediate level of knowledge. So if you add up intermediate, moderate and expert, then S A P S for Ahan Cloud has the most highest number of respondents where those three added together and the business transformation tools from s a Psig NAVO has the lowest number of respondents. Um, it’s not necessarily huge differences. Um, I mean, as you can see, it’s, you know, 24, 34 and 14 for a p s for hana, uh, versus 1728 and seven for the business process transformation tools. But it does give us at least a way to look and see which of these, um, areas or components of RISE with s a P people are most familiar with.

(00:12:36):

Um, not really surprisingly the same as it was last year. Um, S A P S for HANA Cloud is, is the part of s of RISE with s a P that respondents are most familiar with. And I think this is simply because it’s been around for a while. Um, s a P was obviously selling S A P S for HAHAN Cloud before Rise with s a P came into existence. Um, we added a, a new answer choice this year, infrastructure Solutions. Um, interestingly, and I think this sort of speaks to the fact that when you move to RISE with s A P, you do not necessarily need to adopt S A P S for HAHAN Cloud immediately. You do need to commit to a timeline for when you will move to SAP S for HANA Cloud. Um, but I know that many of the organizations that have moved to RISE with S A P are using it, uh, for a lift and shift.

(00:13:22):

They’re using it for infrastructure while they’re planning their move to S A P S for HANA Cloud. Um, and that possibly explains why the infrastructure solutions or the infrastructure component to rise with SAP is perhaps the second most well known area, uh, within the solution. Um, the business Network starter pack, I think people are, are relatively familiar with that was, uh, around the middle last year. Um, the business technology platform, um, interestingly, it’s, there’s quite a few people who have some knowledge, perhaps ones that haven’t necessarily adopted a lot of the way of cloud solutions to the organization. Um, but there’s a, a sort of a drop in intermediate knowledge, and then there’s a larger group that have, uh, moderate to expert knowledge, um, which sort of, uh, suggests that there’s a, people are, people know are hearing the message that s A P is talking about with, with S A P B T P, but they’re not necessarily, um, adopting it yet.

(00:14:26):

Uh, I think, um, in terms of the embedded tools, uh, this was higher last year. I’m sort of a little surprised that the, it, it’s, it’s as low in terms of knowledge as it is because most of these tools, particularly things like SAP Readiness Check, are gonna be used by anyone who’s thinking about a move to S A P SRA hana. Um, you know, you’re gonna check to see your system is available. Um, the custom code migration tools, S A P P enable now, um, you know, these are some of the features that are available, um, often free for any maintenance paying customers, um, in, you know, regardless of, uh, rise with s a P, you know, so outside Rise with s a P and then people, the, the, the, the component that respondents have the least knowledge about is the, the business process transformation tools from s a P sign navo, um, that kind of makes sense.

(00:15:18):

It’s, it’s relatively new to the s a P area. Um, you know, um, business process intelligence tools, and particularly the ones that s A P is offering with rise with s a p probably are not super well known. Um, that is something I know that s a p wants to address, uh, that, you know, they want to get that sort of out more than it is, um, in terms of what areas about rise. But s a p, uh, is most interesting to your organization. Um, now as you can kind of see, um, you know, we’ve compared the numbers from this year, uh, which is the dark blue bar to last year, which is the lighter blue bar, um, just as it was last year. Uh, cost is potentially the factor that is drawing people to, um, rise with s a p, uh, which is also interesting because it’s, uh, as we’ll see later, it’s one of the factors that sort of concerns people most about rice.

(00:16:13):

But SAP p at the same time. Um, but the potential for reducing cost, I think, um, you know, the fact that SAP’s gonna manage everything for you, you’re gonna have a single contract that’s gonna help you with your move to, um, two SAP S for hana. It includes SAP S for HANA Cloud. Um, you know, there’s, there’s certainly a lot of interest there from, uh, from organizations about RISE with a p um, the platform for innovation, which is sort of SAP’s messaging around RISE with s a p over the last 12 months. It’s sort of shifted from that business transformation as a service, um, earlier, uh, earlier response, um, to, uh, to something that is more focused on innovation and addressing some of the immediate needs that s a P knows organization faces. And I think S A P has done a, a good job of identifying some of those areas and sort of connecting them to rise with s a p.

(00:17:13):

Um, it is sort of some interest, but obviously not as much interest as the single contract S A P S for HA cloud, or particularly the cost, um, the, the, the potential for reducing cost. Um, other areas, I mean, the only thing that really changed significantly from last year is the industry specific functionality is of less interest to, um, to organizations. Uh, interestingly, I’m, I’m sort of writing a, uh, in the pr in the middle of writing something about, um, the regionality of the data and those from AMEA are far more interested in the industry specific functionality than those from North America. Um, also the choice of implement implementation partner, I think that was a bigger deal last year than this year. I think people are sort of choosing their implementation partner anyway. One thing that might sort of change over the next couple of years is access to the plan because, um, that is gonna be a big challenge as more and more organizations.

(00:18:16):

I mean, you know, we know that there’s 30 to 35,000, um, enterprise E R P customers who have not yet moved to S A P S for hana. If those customers are to move by the end of 2027, there’s gonna be a lot of implementation work going on over the next five years. I dunno that I necessarily see all those customers moving in that timeframe. Um, but I’m not sure what is gonna happen in terms of, um, you know, what we, what is, what are to sort of try and understand engaging people’s interest around RISE with s A P is whether they’re running S A P or other enterprise workloads, um, in the cloud. So, um, sorry, this is not, this is a slightly different question. This is the use of the cloud for s a P workloads, right? So are you running s a P workloads, uh, in the cloud?

(00:19:10):

Um, so even though 86% of respondents are using hyperscalers in their organization, um, I think what we saw is that only 51% of them are using them for s a P workloads. So those who are using hyperscalers for SAP workloads are, are much more likely to be considering a move to rise with s a P than, than those sort of those who are not. Um, that’s a another data point, but I mean, if we look, we can sort of see that, um, 25% are using private cloud providers. Uh, 21% are using hyperscalers of public cloud providers for SAP workloads specifically, many, I think a much higher percentage are using hyperscalers for non-SAP workloads. Um, 19% are simply not running SAP workloads in the cloud. So only 81% are, are running s a workloads in the cloud. Um, yeah, so there, there’s a sort of a different combination, um, how organizations are, are running their s a P workloads.

(00:20:10):

I think this does sort of track with research that we have done that shows s a p workloads are moving to the cloud, but uh, not necessarily there yet for all workloads or, or even a uniformity in the type of landscape that they’re running on. Um, you know, if you break this sort of down by region, um, you know, those who are using hyperscalers or public cloud providers for their SAP workloads are sort of more likely to be a bit more likely to be from North America, uh, or perhaps a p j than the other regions. Um, north America and a PJ are also more likely to be running their s a P workloads in private cloud providers. So I think that just sort of reflects the fact that, um, I mean, as you can see, EMEA and, um, responders from EMEA and actually and a PJ two are a bit more likely to not be using, um, not be running their s a P workloads in the cloud.

(00:21:06):

Um, whereas, you know, those from North America are more likely to be running their s SAP workloads in the cloud. Um, and that’s not just, that’s not the use of the cloud in general, that’s just their, their SAP workloads. So that, um, but for those outside North America, the, the, the responses are a little bit anecdotal, uh, because they’re not necessarily meeting the threshold that we, uh, we, we hold for, um, the number of responses, um, in terms of the, the size of the organization. Um, you know, cause I wanted, I thought it might be interesting to sort of look at this and sort of determine whether there’s a, a size based factor. Um, it does sort of appear that those organizations from larger, or respondents at least from larger organizations, are more likely to be running their s a P workloads in the cloud than those who are from smaller organizations.

(00:22:05):

So only 13% of those from organizations with revenue above 2 billion, um, annually say that they’re not using running s a p workloads in the cloud as against nearly 30%. Um, so, you know, close to about half as they’re twice as likely, uh, to be not runnings a p workloads in the cloud if they’re from a smaller company. Um, and those from larger organizations are much more likely to be using hyperscale as a public cloud providers or, or using some sort of a hybrid model where it’s a combination of a cloud of the cloud and perhaps some on-premise type, uh, systems.

(00:22:49):

So, um, in terms of those who are not running s a p workloads in the cloud, and, and this is somewhat anecdotal, um, simply because there’s not a huge number of respondents who answered this question. Um, we did ask, what are the factors that are preventing your cloud use for SAP workloads? And I thought this was interesting because it sort of shows cost and security concerns are kind of the biggest thing. I mean, I think while, um, a p particularly, but also many cloud providers would sort of position the cloud as being a cheaper alternative to, um, deploying, uh, you know, buying new capital expenditure infrastructure and deploying in on-premise data centers over time, you know, that those costs can add up. Um, particularly because while you might initially look at the compute time, the data storage fees, um, so how much data do you have?

(00:23:45):

How much compute are you purchasing? There’s also, uh, uh, uh, you know, a question around, um, you know, what, uh, you know, for example, ingress fees, outre fees, um, so, you know, if you’re moving data into the cloud of moving data outta the cloud, that can be a, a significant, uh, significant cost for, um, for organizations. So, um, also I think the, as you can see, the lack of in-house cloud experience is a factor for organizations as well. Um, and then obviously, depending on the type of organization they are, they may have data residency requirements, um, where they have to keep data in an on-premise data center, or at least in a data center that is in a particular country, um, which might prevent them from moving to a public cloud provider. Uh, and I know that some of the regulations in AMEA sort of are, um, even potentially saying that the cloud provider must be, um, must be a majority owned, um, by an, a European company, for example, uh, which I know is the case in France. Now, when asked if the respondents thought the rise with s a P would help address these factors, um, only 29% said yes, uh, but 57% said they, they really didn’t know. Um, only 14% said that a definitive no to that question.

(00:25:18):

So, um, obviously, you know, when you’re thinking about Rise with s a p, you, you initially have that contract with S A P, but beyond that, you have to select who your cloud provider or your cloud service provider is going to be. Uh, you also have to select who your implementation partner is going to be. Um, but when we ask respondents, you know, what factors will be the most important when choosing a cloud provider for a rise, but s a p implement implementation, um, you know, the number one factor is cost. Uh, am I believe that the way that this works from an s a P perspective is that when a customer announces or signs a contract to move to rice with s a p, uh, s A P will generate a bill of materials, um, for, you know, the specifications that the customer provides in terms of size, timeline, data, et cetera.

(00:26:06):

And then they’ll send that to the cloud providers who will then, uh, create a bid, um, for that business. They’ll say, okay, this customer, I’m gonna, you know, charge X for this. And depending on a number of factors, it may or may not. It might actually vary, um, depending on the customer, depending on the region, depending on, um, perhaps the customer’s existing relationship with the cloud provider, the cloud provider also has the opportunity to offer discounts, um, if they wish to do so. Um, but s a P then reports that back to the customer, and the customer chooses which cloud provider they’re going to use. And the number one factor that is apparently driving respondent’s choices when selecting a cloud provider for Rise with s a p is cost. Um, even, you know, even, uh, even much that’s much higher, more than twice as high is having an existing relationship.

(00:26:59):

Um, you know, with that, with that partner, um, because I mean, obviously when you have a Ryan with s a P environment, it, it’s not the same as simply going to a cloud provider that you are already using and implementing another service there because it’s running in SAPs, um, uh, segregated area within that cloud provider. It’s not running in your area, and data will still have to be moved back and forth from Rise with s a p, even if you are running on the same provider. So you’ll have to set up a connection to move that data back and forth. Um, security and performance, obviously, uh, two very important tasks. Ease of migration. Um, people, uh, definitely wanna make sure that, uh, things are, um, most likely to be, uh, easy for them as they move. Uh, but then, you know, from that point on, it’s the, the responses sort of get closer together.

(00:27:57):

Automation of s SAP operations, B T P integration, perhaps an existing relationship, uh, the partner capabilities or the other capabilities that the cloud service provider offers access to other services, um, sustainability, that’s becoming a bigger task, bigger, uh, factor from any organizations infrastructure, uh, and networking and storage at the bottom of that list. Um, now what we also asked is, if you were to implement Rise with sap, would you leverage additional services from your cloud provider? And if so, which services would you use? Now, you know, this is also remembering that your rise with SAP data is in, um, SAP’s area within that provider. It’s not necessarily in yours, but, um, you know, the number one service that respondents said they’re likely to leverage from, uh, a cloud provider would be analytics, uh, followed by data storage, business process automation tools, integration, um, which makes a lot of sense, because if you’re using Rise with s a P on a cloud provider, you’re, you’re gonna need to integrate that with other things that you’re doing on that cloud provider.

(00:29:11):

Um, and then you consider the sort of, see the rest of the list here, low-code development, iot infrastructure, uh, applications, machine learning, uh, data lakes, but obviously, uh, analytics and data storage are two that, uh, organizations are most likely to choose. Now, we did sort of ask the question, if you were to implement Rise with s a p, uh, which service provider would you be most likely to use? This was a multiple choice question. Uh, and respondents only chose one answer. Um, now what is interesting here is, is this, you know, isn’t that different than what we sort of see for, um, service provider usage, other hyperscalers, um, across other s a p insider research as you’re an a s excuse me,

(00:30:05):

You know, largely at the top of that list. Um, what is interesting is SAP Private Cloud, um, now for that, um, because a good number of respondents who are selecting Rise with sap say that they’re planning on running it using, um, even on premise, which is possible using a, uh, using, uh, S A P S for HA cloud private edition customer data center option. Um, but you have to use, uh, either, uh, H P E, GreenLake, Lenovo Tru Scale, or Dell Apex to make that happen. Um, because you’re, you’re basically running a cloud deployment of S C P S for Behind Cloud in your own data center on hardware that you are licensing, you’re not purchasing, um, exactly as it would be with a, with a cloud environment. So part of those solutions might be that option. Um, part might be, uh, the organization is simply hoping to use s a P as their, uh, as their hosting partner, although I don’t know, um, that s a P is doing that, uh, deliberately, uh, doing that.

(00:31:15):

How much s SAP is doing that, um, in terms of, are you considering a move to rise with sp obviously we’ve sort of asked a bunch of questions. Um, so, you know, we really wanted to sort of, um, this was actually from the first rise with s a P survey, and we are sort of just sort of, uh, including this as a comparison point. So this wasn’t actually in the, the survey that I’m reporting on now, but I wanted to sort of provide this data point. Um, 38% say yes, 35% say don’t know, and 30 and 27% say no. But I think when you look at this by revenue, um, and because this is the last report, the colors aren’t quite the same. Um, but you know, those who have re those responders who are from organizations with revenue above 2 billion, a much more likely to not know, um, whether their organization might be considering a move to rise with a a P.

(00:32:18):

And I think this sort of comes from the complexity of their or their landscape, um, perhaps the age of their environment. Um, you know, many of these customers have been running, um, um, you know, have been running, uh, SAP environments for many years. Uh, they may have c Business Suite, some sort of combination of those things. Um, but I mean, obviously those who are smaller are more likely to be considering a move to rise with S A P, nearly nearly two to one, uh, saying yes, they’re organizations considering a move to rise with S A P. And I think this does sort of, um, reflect the fact that, uh, as, uh, um, SAP’s head of sales, uh, Scott blanking on his last name now, sort of said in the last earnings call, and it’ll be interesting to see Scott Russell, um, it’ll be interesting to see what he talks about, uh, in this upcoming earnings call at the end of January.

(00:33:21):

Um, you know, whether or not, uh, s a P continues to see a trend of largely smaller organizations, small, uh, or those of the revenues below 2 billion, uh, potentially, uh, make up the bulk of those who are moving to not only s a s for HA Cloud, but, but, but rises. But S a P, um, interestingly, we sort of asked the que, we, we asked the question, what areas of concern do you have regarding RISE with a P? Um, and I think this is sort of interesting because while the number one thing that is drawing people or potentially interesting people about Rise with a p is the potential for cost savings, um, cost is also an area of concern for people, because I know that some respondents, um, have found that, that I’ve spoken to or that I’ve, uh, exchanged emails with, have sort of said that in their determination rise with s a P would end up being significantly more expensive than their existing, um, excuse me, than their existing in, uh, set up or environment to main to if they were to do that.

(00:34:28):

On the other hand, um, you know, I’ve spoken with customers who are sort of saying that, you know, they were going to move to S A P S for HANA anyway. They did a comparison of S A P S for hana, uh, set up the same way as their existing environment versus S A P S for HANA Cloud and Rise Ryans with s A P, and they found that they could save a considerable amount of money over a five to six year period. Um, so you know, it’s not consistent that there is, uh, you know, that there is, uh, it’s definitely gonna be more expensive or it’s definitely gonna be cheaper. I think it very much depends on your environment, it depends on what you’re trying to do, and it sort of depends on the comparison you do, because, you know, if you are, if the comparison is don’t move versus move to rise with a P, then yeah, I think rise with a P is going to be more expensive.

(00:35:20):

Um, because if you’re not moving, you’re not changing anything, you’re probably, you know, having a limited outlay. But if the, if the comparison is okay, move to SAPs for HANA on a similar environment to what you have now, or move to rise with sap, um, that might be a more meaningful comparison for organizations to sort of engage in and sort of see whether there really is, uh, a cost savings for them. Um, other factors, people concerned about security, uh, connectivity at other cloud solutions. I think because, you know, you’re running, uh, S C P S for around cloud and, and B, VP P in SAP’s environment on the provider, not in your own, um, you know, there is some concern around continuing concern about deployment models for SAP s for hana. Um, I think part of that may simply be education, because while if you do use SAP S for HA Cloud public edition, uh, the only deployment model that’s available to you is a new implementation.

(00:36:21):

Um, if you use SAP S for HA cloud private edition, then all of the deployment models for SAP s for HANA are available to you. System conversion, uh, new implementation or selective data transition. Um, so, you know, there’s, there’s, however, it does require that, uh, s A P S for HA cloud private edition, which is, which is more expensive because it is basically setting up a unique instance of the software in a unique instance of the hardware that no other, um, organizations will be running on. Unlike s sap p s for HA, cloud public edition, which is you’re sharing that software, although not your data, um, with other organizations that are potentially running on the same infrastructure.

(00:37:11):

Um, lack of control, uh, the ability to leverage data inside and outside, I think that says, um, outside, inside and outside riots, but s a P, so that is a bit of a concern. So, you know, moving data back and forth, um, there is some concern for, for mixed men mixed vendor landscapes, many s SAP organizations or organizations running S A E R P systems these days that are running mixed landscapes. They’re not all s a systems. Um, and, and, and obviously there’s concern for a large enterprise support along with clarity about roles during implementation, um, or during, uh, during the project implementation roles data platform. Now, we did ask a similar question last year. It wasn’t an identical question this year, as I’ve just sort of discussed. Um, we asked, what areas of concern do you have regarding Rise with s a p last year, the question was phrased slightly differently.

(00:38:12):

It’s like, where do you see gaps in the rise with s a P offering? So, um, and, and, you know, we, we also didn’t have as many answer choices. Now, the major gap that people identified last year was that support from mixed expender landscapes. Now, if we asked the question in an identical manner this year, we, we might have seen similar respondent responses, but wanted to try and, um, you know, include choices around cost. Um, because I mean, if, you know, people are concerned about cost, we wanna sort of track that. Um, and we will sort of ask a similar question when we run this research again at the end of 2023, um, to sort of get an understanding of, you know, what people, where, you know, where the, where the, the concerns are. Um, but I do, you know, include the chart from last year, which is on the right and has the gray bars as a point of comparison. Um, you know, in each case, respondents could answer, uh, you know, as many, as many responses, uh, multiple responses or all that applied to them.

(00:39:17):

Um, in terms of the concern regarding other enterprise solutions, we did sort of ask this question last year, are you concerned that using Rise with s a p would, excuse me, limit your choices around other enterprise solutions? Um, you know, the numbers did change from last year. Last year. We were relatively split between yes, no, and don’t know with, excuse me, slightly more saying yes than the other two responses. Um, this year, the, the big change is that a much larger group of respondents say that they simply don’t know. Um, and, but only 20 and a and a and a smaller number of respondents, only 29% saying yes, it would limit their choices to 25% saying no, it would not limit their choices. Um, and I think, I think this is an area that s a p needs to address, uh, from an education standpoint.

(00:40:10):

I mean, if I’m using Rise with s a p, if I’m, you know, using some other solution in my workspace that I would typically have integrated a partner solution, a solution from another vendor, um, that I would typically integrate with my E R P system, what is the impact gonna be? Um, you know, am I gonna be able to continue to continue to do that? I mean, for example, if I’m using, uh, a, a tax solution from a third party vendor, if I’m using, uh, a G R C tool from a third party vendor, if I’m using, um, something for billing, if I’m using something for, um, HR management, um, and these are all potentially solutions that could be plugins to, um, to an enterprise E R P system, uh, from right, you know, from s A P that may be much harder to use in a rise with s a P environment.

(00:41:04):

And I think, uh, that’s where the sort of, the fact that people don’t know, um, you know, whether there’s gonna be issues there or not, uh, sort of reflects, uh, the current state this year. Now, in terms of the required actions, I mean, I, I think anyone considering a move to rise with if he really needs to evaluate the cost of making that move cost is, is both the most interesting aspect of Rise with s sap and the biggest area of concern for respondents. Um, some respondent organizations that SAP, PPOs, SAP and Cider spoke to were determined that they could save money by moving to R with s p over an infrastructure I A A S implementation of S 400 in the cloud. Others stated that moving to Rise with s SAP P was significantly more expensive. Um, but if you’re considering a move to rise with s a p, need to dedicate time to understanding the initial cost and the T C O over the next several years, um, make sure your teams are educated, um, give them time to learn about Ryan with s p.

(00:42:06):

You know, despite being released in January, 2021, which is two years ago now, nearly 15% of the respondents stated they weren’t at all familiar with Rise with s a p, and 45% said they were only somewhat familiar. Now, rise with SAP is the focus of SAP’s plans for cloud a r P. So it’s critical that organizations have the knowledge they need to make a comprehensively informed decision, understanding all the components, particularly how rise, but I say people integrate and connect with the existing enterprise landscape is essential to your future e r P plans. And then understand how s A P intends to support rise with s SAP P and mixed fender landscapes. Very few organizations today are running only S a P solutions in their enterprise landscape. Um, while S A P E R P solutions very much often the core of, of that landscape or the core of the business, the research that we’ve done here at S SAP Insider has shown that nine in 10 organizations are doing non-SAP P to s A P integration in their landscapes.

(00:43:07):

And nearly half the respondents to this year’s survey indicated they were unsure how the move to rise with S A P would impact their choices around other enterprise solutions. So any organization on the road to S A P S for HANA must work with s A P to understand how rise with s A P will fit into its environment. And doing this is critical for building a successful enterprise landscape and an intelligent enterprise. So, I’m gonna run through the DART relatively quickly. Uh, we have about 15 minutes left here. Uh, I mean, as you may recall, um, the DART that we, we asked was focused on E R P and innovation. So we’re sort of asking for what are the driving factors or the macro level events that are impacting your organization, um, around E R P and innovation. Uh, they can be, they might be external, they might be internal, they might require the i, they, but they’re going to require the implementation of some sort of strategic plan in order to address, um, actions are the strategies or those strategic plans that companies can implement to address the drivers that are impacting their business.

(00:44:17):

Um, they’re gonna be an integration of people, process, and technology, right? Requirements are the requirements that organizations have to meet to support those strategies. And then the technologies are the technology and systems that they’re enabling the business requirements and supporting the overall strategies that the company is taking. So in terms of the drivers, I mean, what we saw here is that these are the same three drivers in the, in the previous report. The difference here is that we see a greater emphasis on updating and improving existing processes. And that possibly is because, you know, we have such a large respondent group from the us, nearly 50% of responders are from North America, and that’s an emphasis for them. Um, but they, they’re struggling with systems that are not designed for today’s business challenges, or they fail to evolve with the changing business needs and expectations.

(00:45:13):

Now, updating and improving business processes requires an investment on the part of the organization. Um, you know, that might be part of a new e r P project. Now, s a p is positioning solutions from s a Psig navo to help organizations achieve that goal. But more information and knowledge is gonna be required about those components. Um, when it comes to rise with s a P, um, what just as important, I think, is modernization without disruption. Um, you know, it, it’s a challenge for organizations today. Um, moving to S A P S for HANA has been a long project for many customers. I think our deployment approaches for SAPs, for HA research sort of is suggesting that it’s, it’s edging up. Um, you know, it’s at least 12 to 18 months, um, for most org on average. And for many organizations, it’s 18 months to two years or, or longer.

(00:46:10):

Um, on organizations are nervous about embarking on a project like that, particularly because it might limit their flexibility, uh, over the next couple, uh, during the time the project is being implemented. Uh, and you know, right now the market is a little uncertain. Um, it doesn’t seem potentially like, you know, we’re, we’re gonna be entering a significant recession, but organizations need to be able to react quickly. Um, so modernizing without disruption is, is super important to that, you know, because if you’re gonna do a system modernization, you have to have no disruption to the business. You have to be able to run your business as you need to run it right up until the time you switch over to the new system. Um, you know, that’s very important for organizations. Um, in terms of what strategies people are taking, um, I mean, being able to better support data movement and integration is crucial for supporting both the drivers for updating and improving business processes and creating new operational efficiencies, um, as well as that of updated systems and processes.

(00:47:15):

Right? Data is key to innovation. It provides the necessary insights into the way your organization is operating, and it’s the flow of data through the business processes that determines the way your organization runs. Um, implementing transformed and standardized end-to-end processes for core E r P users supports those two driving factors for E R P and innovation, right? This transformation allows organizations to update and improve their existing business processes while creating new operational efficiencies. Something that S A P is really focusing on in their rise with s a p messaging. Now, without this process transformation businesses won’t have the updated systems and processes to efficiently manage their operations. Um, transformed and standardized processes are crucial for modernizing mission critical systems and are the second major driver for E R P in innovation, and then redesigning IT platforms and architectures to lower cost and increase flexibility is another strategy that organizations adopting building that platform for E R P and innovation.

(00:48:18):

So, as we observed in our report, S A P Infrastructure and Landscape Trends in August, reducing costs while increasing flexibility as well as scalability are the two most important factors driving infrastructure change in the s a p ecosystem today. So with respondents selecting this as the third most important strategy supporting E R P and innovation, it shows that these factors are equally important when building a platform for innovation. And that having the best infrastructure is a key component. So in terms of what should you do, I mean, given, you know, these drivers, given these, you know, actions that people can take, I think start evaluating your existing business processes today to determine whether they’re gonna meet your future needs and the regulatory future regulatory requirements. It doesn’t matter whether you’re moving to rise with s a P or not. Every organization with future E R P and innovation plans must understand and evaluate their existing business processes to see whether they’re effectively meeting their current needs, and if they’re equipped for the future, determining which processes can be eliminated or which can be updated can be a significant effort.

(00:49:25):

So starting this process as soon as possible is gonna be key to whatever your future E R P move is, and to make that successful, um, extend transformation plans beyond infrastructure to include systems and processes. You know, I think many SAP organizations are planning to replace their existing SAP infrastructure over the next few years, um, often in a conjunction with a move to SAPs for hana. But infrastructure transformation shouldn’t be the extent of your transformation plans. Architecting a unified IT landscape should be part of your strategy. But process, business process transformation is just as important as infrastructure transformation. Implementing transformed and standardized end-to-end processes is key for nearly half the survey’s respondents. And that’s also central to implementing future innovation such as automation and machine learning. So ensure that your organizational planning includes both business and infrastructure transformation. And then lastly, determine how cloud service providers can help provide the platform for those innovation plans. Um, while choosing the right cloud service provider is essential evaluating the additional services the provider offers to accelerate those plans for innovations. Equally important, all providers have the capabilities that can or have the capabilities that can enhance our complement plans for driving innovation. However, because services offered, um, uh, by each provider and the way they integrate with S A P can vary, understanding these differences will be crucial for your final cloud service provider selection.

(00:51:03):

In terms of, um, you know, some of the requirements people say they need to make around E R P in innovation, comprehensive monitoring that’s for both ensuring and system health and security. It’s critical, obviously for the ongoing stability of your E R P system in its data. Um, Elsa supports modernizing emission critical systems without disruption, um, frequently changing regulatory requirements. Um, changes are happening all the time. Uh, so it’s crucial and equally challenging for organizations to ensure that they’re meeting the cha they’re changing data management requirements. Now, this requirement for business process models that meet regulatory requirements for data management connects to the driver of business process de business, demanding updated systems and processes that benefit current needs and regulatory requirements that also supports the strategy of having a unified IT landscape to provide better movement and integration of data. So with a landscape, uh, that moves and integrates data, it is possible to meet management requirements and ensure your data is protected.

(00:52:09):

Um, ability to have insights in the process performance. I mean, if you’re building a platform for E R P and innovation, I mean, this is why S A P acquired Zig navo in 2021, so that they could provide ongoing insight into how processes work across an organization. But while many organizations are still evaluating B P I tools, they are critical for GA providing insights to the way an organization operates. So given the importance of this requirement to respondent organizations, I think s SAP needs to educate people about how s SAP psig NAVO tools work and function as well as they role they can play in delivering insights. And then lastly, um, experienced migration partner. Many large organizations have extensive historical data in their existing E R P system, so it’s really no surprise that having a partner with experience migrating and managing data into a new E r P system is the fourth most important requirements.

(00:53:05):

However, finding a partner with this experience might be difficult because of a limited availability of experience partner resources over the next few years, particularly if there’s a surge for organizations moving to SAPs for hana. Um, therefore, organizations should prioritize formalizing your plans until they, that they can access the resources, um, when they need them. So prioritize your finding, you know, formalizing your plans so that you will have the resources you need available when you need to have them available. Um, in terms of some of the different technologies that a people are planning or using for E R P and innovation, I think resilience is one of the most important things a system needs if organization is looking to build a platform, uh, for innovation. So it’s really no surprise that most technology when it comes to E R P and innovation is high availability in disaster recovery.

(00:54:00):

Um, you know, I think managed infrastructure on premise, that’s not necessarily something like, uh, GreenLake Apex or True Scale. Um, but I mean, this is an environment that someone is managing for you. Um, it helps, does help you potentially move resources onto higher priority projects, uh, cloud-based systems, what people are leveraging software as a service deployments. But if we look at sort of where people are planning on investing, so these are the, this is where people are implementing over the next 12 to 24 months. Um, cloud-based e r p software as a service, deployments, cloud-based platforms and infrastructure, business process transformation tools, data cleaning tools, you know, these are really important for anyone doing an E R P system update, right? You know, where you’re deploying your E R P, what is it gonna provide you with from a functionality standpoint? Um, is it gonna give you the innovation you need?

(00:55:05):

And then lastly, sort of technologies fulfilling requirements. I think the tech, sorry, these are the ones that people are evaluating for use, uh, beyond the next couple of years. So technologies that respondents identified as being evaluated for use in the landscape were data cleansing tools, business process transformation tools, custom code lifecycle management, s A p, managed and tuned infrastructure. Um, now that’s part of RISE with s a p as well as existing S a P ha Enterprise Cloud, uh, offering and allows s SAP p to provide system specifications that are managed by SAP P and are precisely tuned to SAP solutions. So what should you do? Deploy solutions that will help better monitor and visualize the performance of your SAP P systems and landscape. Um, any e r P system consists of not just the E R P software itself, but also the interconnected systems in the landscape or less.

(00:55:59):

If you offer some monitoring of systems through tools like s SAP Solution Manager, often there’s a visualization gap is, particularly if you’re looking to get realtime insights into your s SAP P systems, while comprehensive monitoring ensure system health and security, the most important requirement for E R P and innovation, it’s also extremely important to deploy solutions that help visual address vi those visualization gaps and provide better monitoring, evaluate business process intelligence and business process intelligence transformation tools, um, that are gonna provide you with insights. I mean, I think building an E R P system for the future involves ensuring that outdated processes are unused code, um, from existing systems are not transitioned into the new system. Uh, as well as putting in place only what matches the current business model or is necessary to meet regulatory requirements, uh, to sort of ensure this organizations need to have B P I tools and business process transformation tools that provide insights, how processes work, their performance, and how data flows across the environment.

(00:57:06):

Um, and you should start looking at that to see what you can do with what you have. And then lastly, start the process of finding implementation and deployment partners today. If you’re, there’s many organizations that are potentially moving to S A P S for HANA over the coming few years. You wanna make sure that you don’t, you don’t have a situation where you cannot find the part you partner you need. Um, having a partner with experience moving historical data, I think is one of the top four requirements for organizations. Um, so to ensure that your organizations can work with the department they want in the timeframe they need them, don’t delay. Um, so additional insights. We did ask people where they’re running and what they’re running. Um, these aren’t necessarily in production. These aren’t necessarily the production system. I think it is interesting that, um, 41% say they’re running a C P S for hana.

(00:58:01):

This is higher than we’ve typically seen from responses, but possibly because this is a rise with s a p survey. So it’s sort of focused on that. Um, but overall from a recommendation standpoint, dedicate time to understanding the benefits and features of Rise with s A P and whether it’s the right choice for you for customers not running a p s for a hundred cloud, there’s gonna be a significant push over the coming years to move to Rise with s A P if there hasn’t already been. So, while many organizations had an initial concerns over the potential deployment models, a new implementation initially being the only choice when moving to SAPs for a HA cloud, that’s no longer the case. And the included products and services offer benefits to organizations that wanna leverage them. Understanding Rise with s a P and whether it fits your needs is crucial because it not only helps in making an informed decision, but it helps with your conversations with your SAP team and SAP account executives prepare your organization so that you can effectively build a platform for future innovation.

(00:59:03):

One of the benefits of RISE with SAP is it includes the components needed to build that innovation platform. SAPs for hundred Cloud is the platform’s. Core services from cig, NAVO allow for insight into and transformation of business processes. And B T P extends and enhances. However, whether organizations intend to use RISE with a a p or some other combination of technologies, the most important thing is to ensure that the, your organization is prepared. Whether you’re building a platform for sustaining innovation or disruptive in sustaining innovation, or doing disruptive innovation, you need to understand the problems you’re trying to address, engage with business teams to challenge assumptions and look at solutions to help address those challenges and implement the technologies that you need to drive success. Um, engage and utilize business teams to ensure that what you build for E R P N innovation meets the needs and requirements.

(00:59:57):

It’s only your business teams that have that knowledge. You don’t want do an implementation and suddenly find that nobody is using it because business teams are the primary users of your solutions. They should determine which functionality is used and whether it should be adopted. This is especially true when building an innovative landscape around the E R P system. Um, engaging teams in innovation and transformation projects early in the process and facilitating them, dedicating their time to these projects ensures success. And lastly, start planning now for future E R P and innovation projects and software deployments. SAP’s deadline is 2027. Um, it’s still five years away, or just under five years away now. But with the average length of time of an SAPs for HANA implementation being 18 months, not including building the business case, it takes a while to get there. Now, not every project is gonna take that long to complete, and s a P is looking to ensure that a move to rise with s a P is substantially shorter than other deployments.

(01:00:58):

Um, but time of the is of the essence for an enterprise e r P solution. This is especially true when it may take months before the partner of your choice has availability for the resources that you need. Unfortunately, that is all the time we have for today. Uh, I’ll follow up on, uh, any unanswered questions in the next couple of days. I do wanna thank you for attending today’s webinar. Uh, surely after the event, you’ll receive an email to access the presentation on demand, along with the slides. Um, on behalf of sap, the S a p Insider and our sponsors at Camp Gemini, Google Cloud, Microsoft Azure, red Hat and Software one. Thank you for your time and have a great day.