SAP Cash Application Leverages Machine Learning

Accounts Receivables Teams Benefit from Automation

By Birgit Starmanns, Global Head of oCFO COE Thought Leadership Strategy and Programs, SAP

Contributing Editor: Fred Donovan, SAPinsider

Machine learning helps finance and risk teams increase automation and handle exceptions, streamlining business processes and reducing manual errors. As opposed to rules configured in tables — which are often never revisited, even when the business environment changes — machine learning means just that: the system learns how to handle exceptions based on historical transactions as well as on any human, manual actions taken to deal with exceptions in the past.

Explore related questions

The first of many machine learning applications in the finance and risk portfolio in SAP S/4HANA Finance is SAP Cash Application, which streamlines the clearing process of open items for accounts receivable (A/R) transactions. When new transactions come into the system that result in exceptions, the machine learning application takes that prior information and decides on the course of action, such as a proposal for review or an automatic clearing posting.

To begin, let’s look at A/R and the importance of SAP Cash Application.

SAP Cash Application as Part of the A/R Process

The traditional process of A/R spans several steps, as shown in Figure 1. As a contract or sales order is created, there is a credit check against the customer, but there is no impact to general ledger accounts in the Universal Journal. Once approved, normal logistics processes take place to fulfill the sales order, whether the manufacturing or assembly of a customized product or the sale of a product already in stock. Once the product is shipped, resulting in a financial posting against the cost of goods sold (COGS) account, the A/R process then creates an invoice, which is considered in working capital and cash flow analyses. Payment is made by the customer, which may or may not include collections and dispute activities. Once payment has been received, it is posted in A/R and cleared against the invoiced amount.

Figure 1: Traditional A/R process

The clearing of the open A/R line items is based on rules that have been configured within SAP S/4HANA Finance, including payment terms and tolerance levels to ignore minor differences. However, there may be many situations in which there is no one-to-one match, within the specific tolerance level, between the invoiced amount and the payment received from the customer. This could be for several reasons: the information provided with the payment may be incomplete, a reference number to the order may be missing, payment advice documentation is not legible, or duplicate master data records for the customer may exist. Alternately, there may be discrepancies in the amount paid. For example, the customer may have paid for more than one invoice in one payment, the payment received is a partial payment, there may be discrepancies based on currency conversions, or the customer may have taken an unallowed discount or paid without taking advantage of an available discount. In these and other situations, the clearing process is not straightforward, and the finance or shared services teams responsible for A/R will need to reconcile these exceptions manually. In some cases, this means reaching out to the customer.

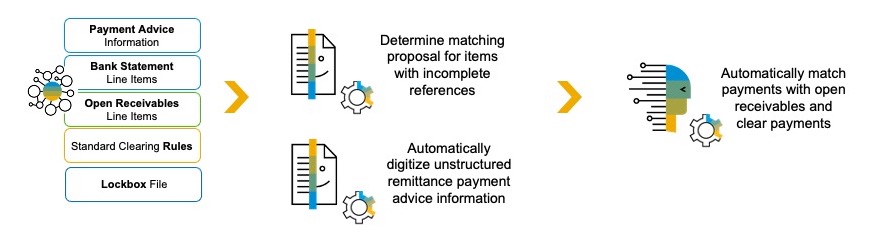

The standard clearing process is based on the rules in configuration tables in SAP S/4HANA Finance. To reduce the number of exceptions, SAP Cash Application was developed as a next step that includes machine learning to clear as many of these remaining open items as possible. As shown in Figure 2, SAP Cash Application is able to act on a variety of inputs to the machine learning algorithm to clear open A/R items.

SAP Cash Application

Figure 2: SAP Cash Application uses machine learning to clear A/R items that were not able to be cleared through the standard configured rules

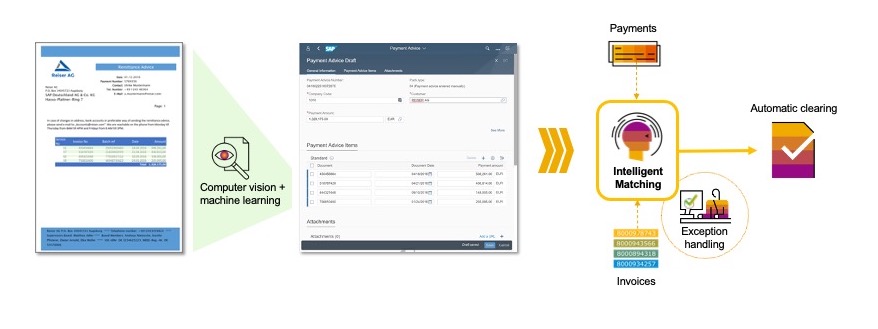

Line items for clearing can come into SAP S/4HANA Finance in multiple ways, including open receivable line items resulting from the sales order process, which may be entered manually, or records imported from a bank statements file or a lockbox file. In addition, the processing of unstructured data for payment advice information is also incorporated by SAP Cash Application, as shown in Figure 3. The format could be a PDF, a scanned document, an image, or an email. In these situations, optical character recognition (OCR) is used to read the input documents and extract the key information to populate transactions in the system. If the unstructured data is an audio file, such as a voicemail, it can also be transcribed using natural language processing and then used as input.

Payment Advice Extraction

Figure 3: Payment Advice Extraction for SAP Cash Application allows unstructured data to be incorporated into the A/R process.

Once the machine learning algorithm is applied, many exceptions to the open items can be cleared. A company may choose to allow the application to post these cleared items automatically, as long as they meet the designated confidence level, such as 90% certainty that the logic applied has resulted in the correct proposal. This tolerance level can be configured in SAP Cash Application. Other companies may choose disallow automatic postings, choosing to examine the line items that would have been posted and then manually release them. Typically, after some time, most companies do allow the system to post these items automatically. This leaves only a fraction of the line items that must still be handled manually as true exceptions.

SAP Cash Application is built on SAP S/4HANA Finance, leveraging both the core A/R processes and the machine learning engine. It has been available in the public cloud since release 1802 and on-premise since release 1709. A special adapter has now been built to allow the application to run against SAP ECC 6.0, with EHP7+.

Now that we understand the capabilities of SAP Cash Application as part of the overall A/R process, let’s take a look at how the machine learning engine is trained to create the appropriate algorithms.

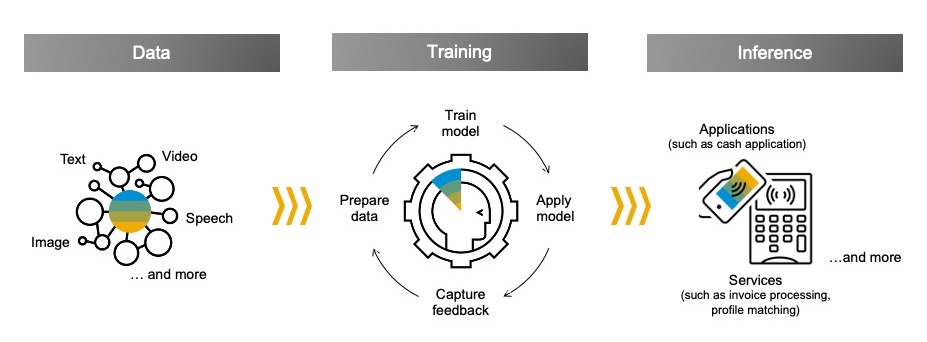

Training the Machine Learning Engine

Before implementing SAP Cash Application, the machine learning engine must be trained to learn and incorporate knowledge of prior transactions and how exceptions were handled, even when handled manually. Figure 4 highlights the process of training the machine learning engine.

Figure 4: Training of the machine learning engine involves incorporating historical information, iteratively processing this logic on new data sets, and incorporating feedback to refine the algorithm to make the correct inferences on the receivables open items.

Training begins with the incorporation of historical information, which includes business partner information such as the customer ID and customer name, bank master data, and product master data. Additional transactional information includes prior electronic bank statements, notes and payment advice records, payer bank account information, and core financial accounting documents in the Universal Journal.

The machine learning engine builds an algorithm by learning the correct decision criteria, tolerance of values, and the priority of applying them against incoming payment transactions. Then, with the preliminary algorithm created by the machine learning engine, this logic is used iteratively on new data sets. The system again learns with feedback from the finance team on which recommendations are appropriate and which are not.

Once this iterative training cycle has been completed, the logic is used to infer the correct actions. For example, with no match of a business partner in an incoming record, the correct customer number can be inferred from bank statements by matching the reference number of a particular transaction.

Once trained, it is not necessary to “re-train” the machine learning engine in the future. While new exceptions may result after a change in business processes or the business environment, the system learns how to handle these exceptions on an on-going basis and incorporates them to refine the algorithm used to match receivables where there are future similar exceptions.

SAP Cash Application has embedded the machine learning engine that is part of the SAP AI Core, which is delivered in the SAP Cloud Platform. The application, while residing in the cloud, can run against both on-premise and cloud implementations of SAP S/4HANA Finance.

Next, let’s take a look at how to verify that SAP Cash Application made the correct decision for clearing open items that initially had exceptions.

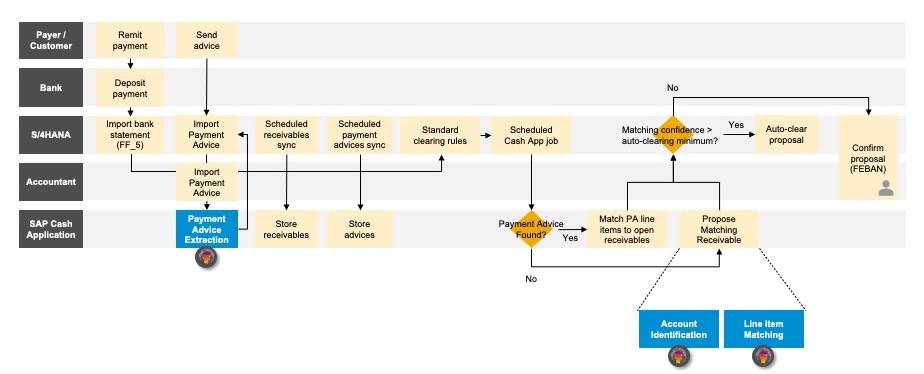

Explainable Artificial Intelligence in SAP Cash Application

SAP Cash Application brings information from different actors together, as shown in Figure 5. Input of the payment comes from the payer (customer), either directly or through the bank. The information is stored in SAP S/4HANA Finance for receivables management. Machine learning is applied during the processing payment advice documents, as well as during the core processing of SAP Cash Application. With this type of automation, the accountant does not need to process all transactions manually, so there is only a limited need for intervention, such as manual imports of payment advice documents and confirming any remaining clearing proposals by the system. Ultimately, only a subset of transactions will remain that require true exception handling; once they have been manually cleared, the machine learning engine uses these actions as input into refining its algorithm.

Figure 5: Machine learning is applied for Payment Advice Extraction for SAP Cash Application, and then during the processing of A/R clearing by SAP Cash Application, using account identification and line-item matching.

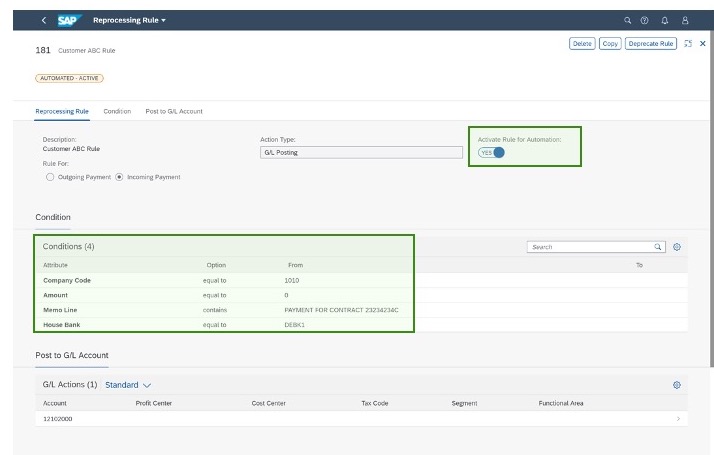

SAP Cash Application can be set up with specific criteria for matching even as the data comes into SAP S/4HANA Finance. When a file is imported, such as a bank statement (Figure 6), individual conditions can be specified for the matching logic to process clearing. In addition, when the Activate rule for automation parameter is turned on, machine learning is automatically leveraged to apply more sophisticated logic beyond the standard reprocessing rules and the defined conditions.

Figure 6: In importing a bank statement, the matching criteria are defined under the Condition section, which can be supplemented with additional machine learning algorithms.

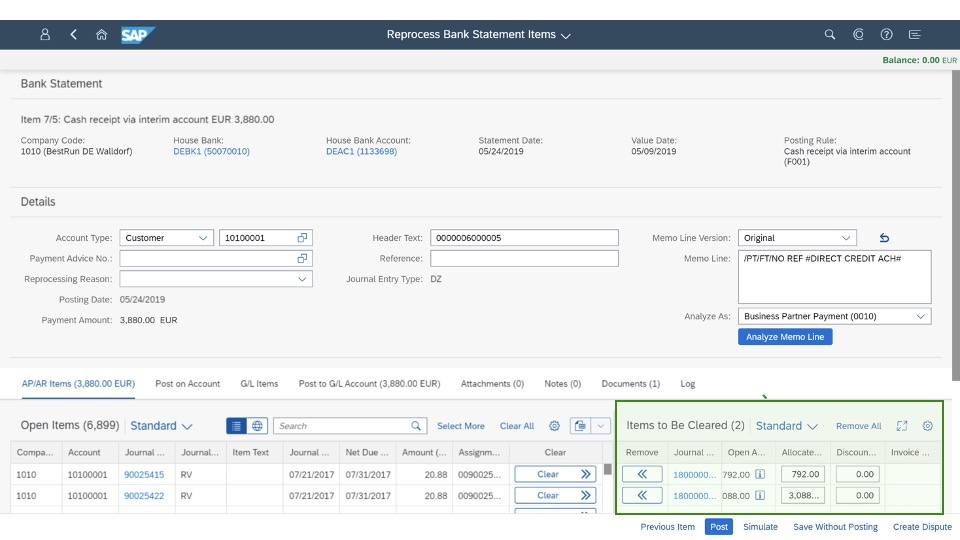

After the SAP Cash Application solution has run, the list of items to be cleared is displayed for each transaction, as shown in Figure 7. It is possible to allow the application to clear and post these items automatically, or they can be reviewed by a finance team member who can then release each item to be posted.

Figure 7: A proposal of items to be cleared is shown; these items were previously identified as exceptions

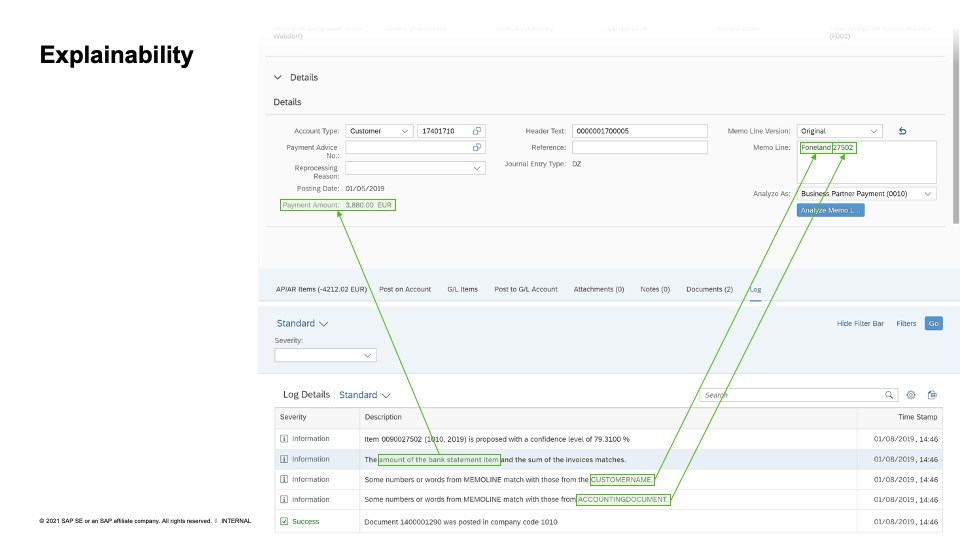

Once matching has taken place, a log explains the artificial intelligence (AI) rules and the features that influenced the match, which also has the benefit of providing auditability for the clearing process with SAP Cash Application.

Figure 8: At a transaction level, the different criteria — shown here are the payment amount, customer name, and reference number — are all matched for a high level of confidence

Now that we have seen the process of clearing and how the logic of the machine learning algorithm is applied, let’s take a look at a special case of SAP Cash Application for high-volume usage-based scenarios.

SAP Cash Application for High-Volume Use Scenarios

Most recently, a version of SAP Cash Application specific to FI-CA (the Contract Accounts Receivable and Payable module) has been released. FI-CA is used in SAP Billing and Revenue Innovation Management scenarios, usually involving high-volume, consumer-based business scenarios. Examples of the use of FI-CA include invoicing for consumption-based billing used in industries such as utilities and telecommunications; billing for services, subscriptions, and loyalty programs; complex solution order management, which includes both products and services; and complex multi-party billing that involves a revenue share with partners. It is now possible to leverage the machine learning of SAP Cash Application, add-on for contract accounting, which was released in the fourth quarter of 2020.

Summary

SAP Cash Application helps automate the application of receivables to increase efficiency and to reduce manual tasks. Benefits include a lower error rate; lower cost of processing A/R transactions, including in shared services environments; and fewer exceptions that need to be handled manually, thereby increasing the productivity of finance teams. This reduces the days sales outstanding (DSO), a key performance indicator for many companies. Ultimately, this application frees up the time of finance teams to be a more strategic partner to the business.

For more information about SAP S/4HANA Finance, including customer stories, please visit https://www.sap.com/products/erp-financial-management.html. And for information about SAP Cash Application, visit https://www.sap.com/products/cash-application.html.